On Friday, the EUR rose 0.27% against the USD and closed at 1.0957.

In economic news, Germany’s industrial production declined 1.4% MoM in June, against market expectations of an increase of 0.3% and following a revised gain of 0.2% in the preceding month. Meanwhile, the nation trade surplus widened more than expected to €22.0 billion in June, from prior month’s surplus of €19.5 billion, while current account surplus advanced to €24.4 billion in June, compared to prior month’s revised reading of €11.8 billion.

The greenback lost ground, after the US non-farm payrolls rose less than market forecasts to 215 K in July, from prior month’s revised reading of 231 K. Markets expected it to increase to a level of 225 K in July. Meanwhile, unemployment rate in the nation remained unchanged at 5.3% in July from June, at par with market expectations.

Other economic data showed that average hourly earnings of all employees registered a rise of 0.20% on a MoM basis in July, in line with consensus estimates. Also, consumer credit rose $20.74 billion in June, beating market expectations for an advance of $17.00 billion. In the previous month, it had advanced by a revised $16.52 billion.

In the Asian session, at GMT0300, the pair is trading at 1.0962, with the EUR trading marginally higher from Friday’s close.

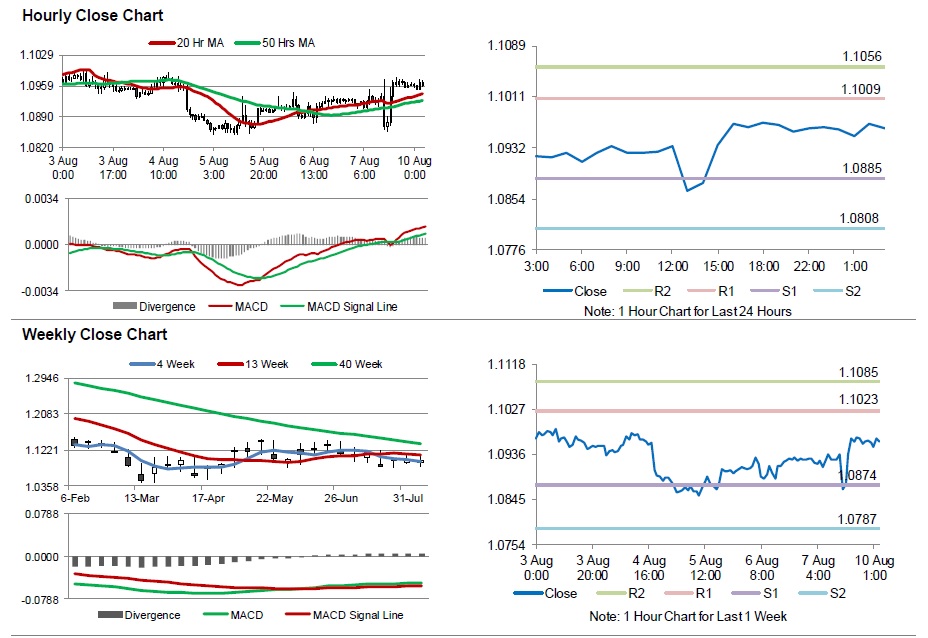

The pair is expected to find support at 1.0885, and a fall through could take it to the next support level of 1.0808. The pair is expected to find its first resistance at 1.1009, and a rise through could take it to the next resistance level of 1.1056.

Trading trends in the Euro today are expected to be determined by the Euro-zone’s Sentix investor confidence.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.