For the 24 hours to 23:00 GMT, the EUR declined 0.72% against the USD and closed at 1.1207.

In economic news, the Euro-zone’s seasonally adjusted industrial production rebounded above expectations by 1.1% MoM in April, a reassuring sign for the region. Investors had expected it to rise by 0.8%, following a 0.7% decline in the previous month.

The greenback gained ground after US retail sales posted a robust increase in May, indicating that the nation’s economic growth was gaining steam despite a sharp slowdown in job creation. Data showed that US advance retail sales rose more-than-expected by 0.5% in May, rising for the second consecutive month and after recording a 1.3% growth in the previous month. Additionally, the nation’s import price index advanced above expectations by 1.4% MoM in May, its biggest increase in more than four years and following a revised rise of 0.7% in the previous month.

In other economic news, the US NFIB small business optimism index surprisingly rose to a level of 93.8 in May, after recording a reading of 93.6 in the previous month. On the other hand, the nation’s business inventories advanced less-than-expected by 0.1% in April, following a revised rise of 0.3% in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.1200, with the EUR trading 0.06% lower against the USD from yesterday’s close.

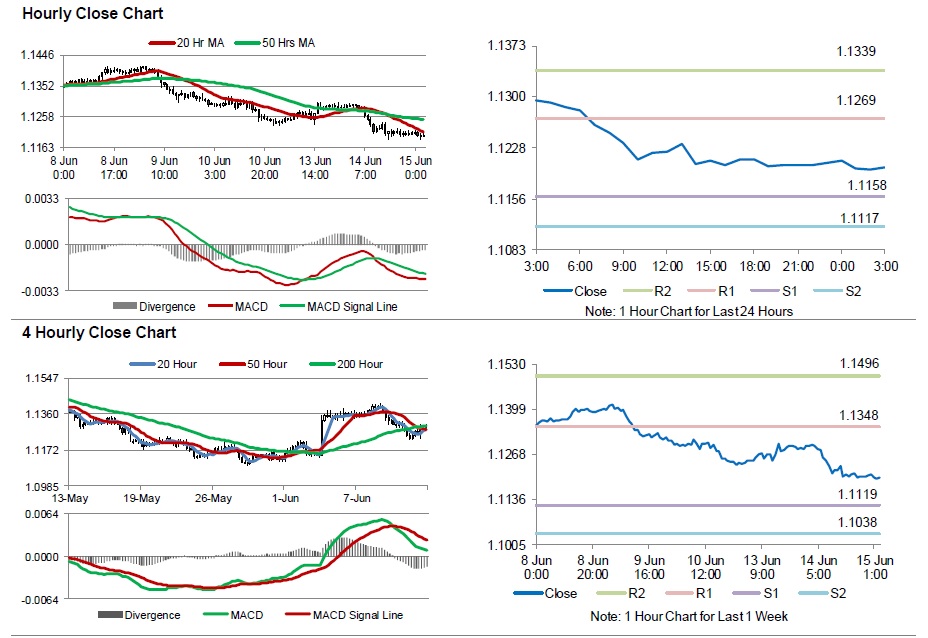

The pair is expected to find support at 1.1158, and a fall through could take it to the next support level of 1.1117. The pair is expected to find its first resistance at 1.1269, and a rise through could take it to the next resistance level of 1.1339.

Moving ahead, investors will look forward to the Euro-zone’s trade balance data for April, scheduled to release in a few hours. Moreover, the US Federal Reserve’s interest rate decision, along with the nation’s industrial production and weekly mortgage applications data, due later today, will be keenly watched by market participants.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.