For the 24 hours to 23:00 GMT, the EUR slightly declined against the USD and closed at 1.1773.

On the macro front, Italy’s seasonally adjusted retail sales unexpectedly eased 1.0% on a monthly basis in October, dipping to its lowest in over a year and compared to market expectations for a fall of 0.1%. In the previous month, retail sales had recorded a revised rise of 0.8%.

In the US, data revealed that JOLTs job openings fell more-than-expected to a level of 5996.0K in October, compared to a revised level of 6177.0K in the previous month. Markets were anticipating for a drop to a level of 6135.0K.

In the Asian session, at GMT0400, the pair is trading at 1.1769, with the EUR trading marginally lower against the USD from yesterday’s close.

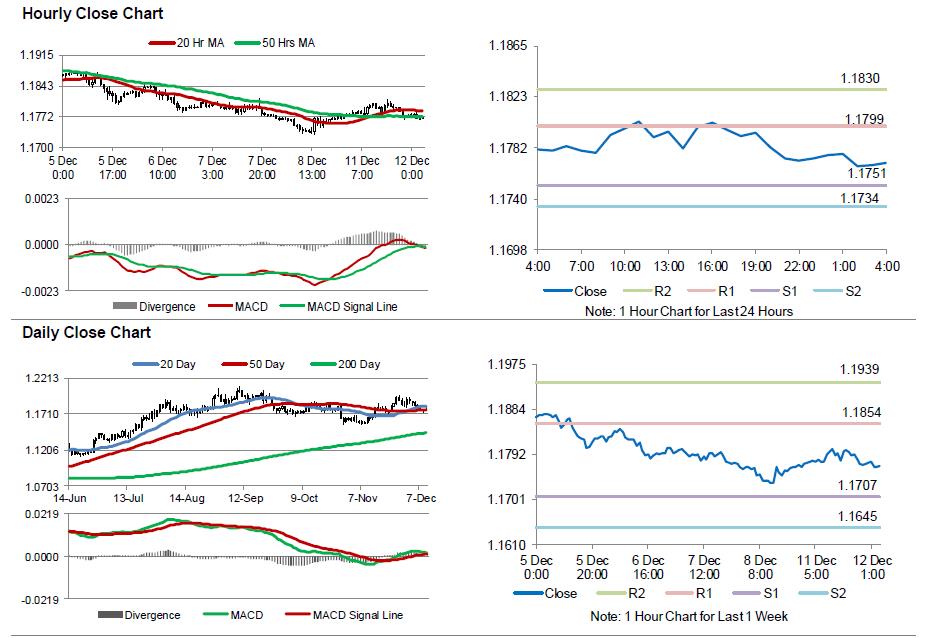

The pair is expected to find support at 1.1751, and a fall through could take it to the next support level of 1.1734. The pair is expected to find its first resistance at 1.1799, and a rise through could take it to the next resistance level of 1.1830.

Trading trend in the Euro today is expected to be determined by the release of the ZEW economic sentiment index for December across the Euro-zone, scheduled in a few hours. Moreover, the US NFIB small business optimism index and monthly budget statement, both for November, due to release later in the day, will be on investors’ radar.

The currency pair is trading below its 20 Hr moving average and showing convergence with its 50 Hr moving average.