For the 24 hours to 23:00 GMT, the EUR declined 0.14% against the USD and closed at 1.1750.

The US dollar rose against the euro, after the US Federal Reserve (Fed) raised its key interest rate for the third time this year.

The Federal Open Market Committee, in its September monetary meeting, raised its benchmark interest rate by 25 basis points to 2.25%, as widely expected and projected one more hike this year followed by three hikes in 2019. In a statement accompanying the decision, the central bank maintained its optimistic view on the steady growth of economy and a strong job market. Further, the officials upgraded their outlook for the US economic growth. The policymakers now expect the economy to grow by 3.1% in 2018, up from previously estimated 2.8% and 2.5% in 2019 from 2.4%. Meanwhile, the central bank dropped its previous assurances that policy was “accommodative”.

In the US, data showed that the new home sales rebounded 3.5% on a monthly basis to a level of 629.0K in August, less than market expectations of 630.0K. In the previous month, new home sales had registered a revised level of 608.0K. Moreover, the nation’s MBA mortgage applications rose 2.9% on a weekly basis in the week ended 21 September 2018. Mortgage applications had registered a gain of 1.6% in the previous week.

In the Asian session, at GMT0300, the pair is trading at 1.1748, with the EUR trading slightly lower against the USD from yesterday’s close.

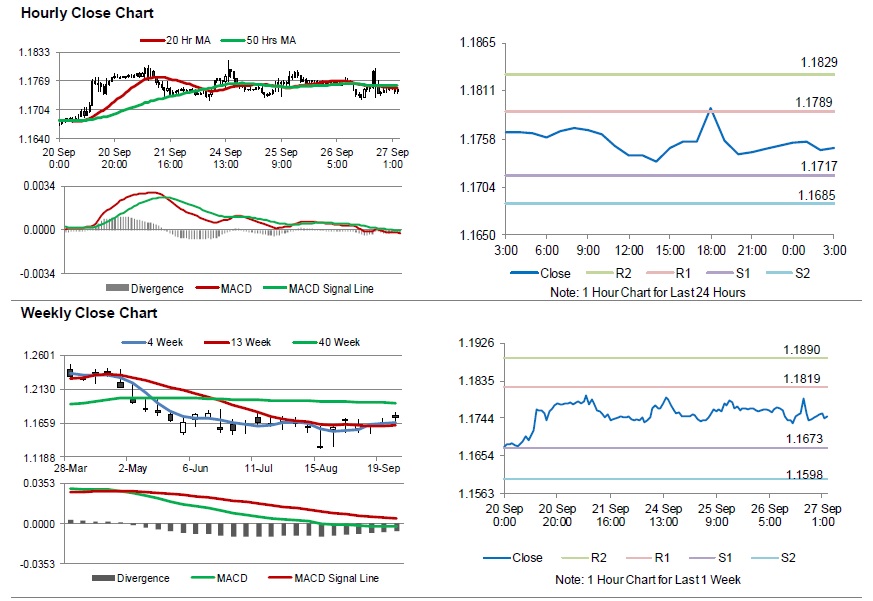

The pair is expected to find support at 1.1717, and a fall through could take it to the next support level of 1.1685. The pair is expected to find its first resistance at 1.1789, and a rise through could take it to the next resistance level of 1.1829.

Going ahead, traders would closely monitor the Euro-zone’s consumer confidence, economic confidence and business climate indicator, all for September, along with Germany’s Gfk consumer confidence for October and the consumer price index for September, set to release in a few hours. Later in the day, the US advance goods trade balance, durable goods orders and pending home sales, all for August followed by the 2Q gross domestic product figures and initial jobless claims will garner significant amount of investors’ attention.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.