For the 24 hours to 23:00 GMT, the EUR rose 0.26% against the USD and closed at 1.1378.

Data indicated that Germany’s construction PMI expanded to a level of 51.3 in November, compared to a reading of 49.8 in the preceding month. Moreover, the nation’s seasonally adjusted factory orders unexpectedly rose 0.3% on a monthly basis in October, registering its third consecutive month of gain and cofounding market consensus for a fall of 0.4%. In the previous month, factory orders had recorded a revised advance of 0.1%.

In the US, data showed that the US ADP employment rose by 179.0K in November, undershooting market expectations for an advance of 195.0K. The private sector employment had registered a revised gain of 225.0K in the prior month. Furthermore, seasonally adjusted initial jobless claims declined to a level of 231.0K in the week ended 01 December 2018, following a revised level of 235.0K in the prior week. Markets were expecting initial jobless claims to fall to a level of 225.0K.

On the contrary, the US trade deficit widened to a decade high level of $55.5 billion in October, amid surge in imports, due to ineffective tariff imposed by US President, Donald Trump’s administration. The nation had registered a revised deficit of $54.6 billion in the previous month, while market participants had anticipated for a deficit of $55.0 billion. Also, the nation’s final Markit services PMI slid to a level of 54.7 in November, while preliminary figures had indicated a drop to a level of 54.4. In the previous month, the PMI had recorded a reading of 54.8. Additionally, final durable goods orders dropped 4.3% on a monthly basis in October, higher than market expectations for a fall of 2.4%. In the prior month, durable goods order had recorded a revised drop of 0.1%, while preliminary figures had indicated a drop of 4.4%. Moreover, the nation’s factory orders dropped 2.1% on a monthly basis in October, more-than-anticipated and compared to a revised rise of 0.2% in the prior month.

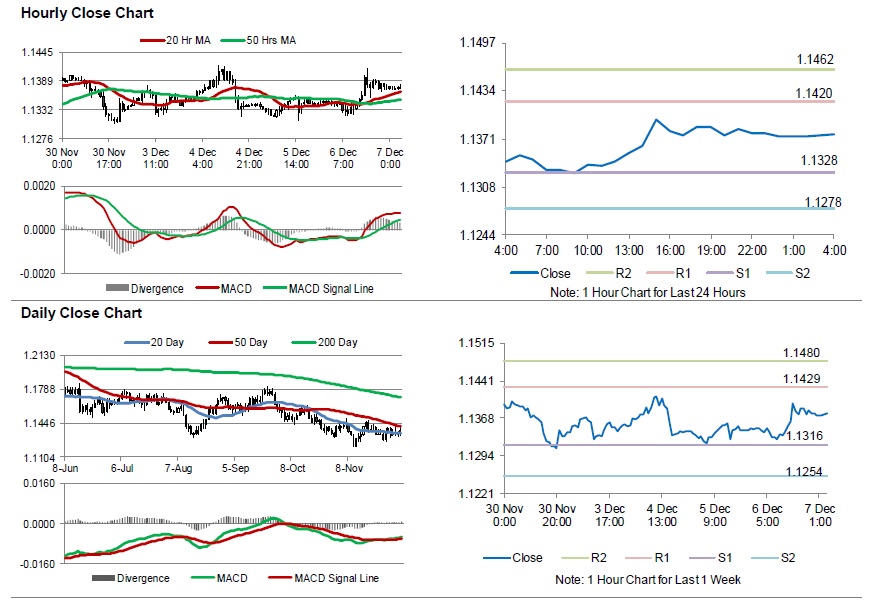

In the Asian session, at GMT0400, the pair is trading at 1.1377, with the EUR trading slightly lower against the USD from yesterday’s close.

The pair is expected to find support at 1.1328, and a fall through could take it to the next support level of 1.1278. The pair is expected to find its first resistance at 1.1420, and a rise through could take it to the next resistance level of 1.1462.

Going ahead, investors would await the Euro-zone’s 3Q gross domestic product along with Germany’s industrial production for October, set to release in a few hours. Later in the day, the US non-farm payrolls, unemployment rate, private payrolls and average weekly earnings, all for November followed by the US initial jobless claims and the Michigan consumer sentiment index for December, will pique significant amount of investor’s attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.