For the 24 hours to 23:00 GMT, the EUR rose 0.11% against the USD and closed at 1.1145.

In the US, data showed that the Dallas Fed manufacturing business index rose to a level of -6.3 in July, compared to a level of -12.1 in the previous month. Market participants had anticipated the index to record an advance to a level of -6.0.

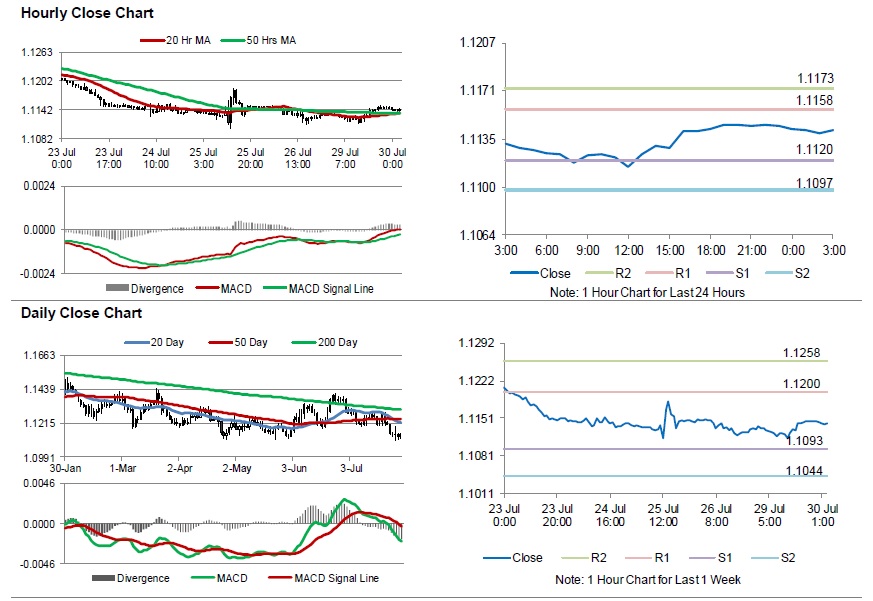

In the Asian session, at GMT0300, the pair is trading at 1.1142, with the EUR trading slightly lower against the USD from yesterday’s close.

The pair is expected to find support at 1.1120, and a fall through could take it to the next support level of 1.1097. The pair is expected to find its first resistance at 1.1158, and a rise through could take it to the next resistance level of 1.1173.

Looking ahead, traders would keep an eye on Euro-zone’s economic confidence, industrial confidence, services confidence and consumer confidence indices, all for July followed by Germany’s consumer price index for July and the Gfk consumer confidence index for August, set to release in a few hours. Later in the day, the US personal income, personal spending and pending home sales, all for June, along with the consumer confidence index for July, will garner significant amount of investors’ attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.