For the 24 hours to 23:00 GMT, the EUR rose 1.20% against the USD and closed at 1.1351, after the preliminary estimate of the Euro-zone’s GDP growth accelerated in Q1 2015.

Yesterday’s data showed that the Euro-zone’s seasonally adjusted preliminary GDP climbed 0.40% on a QoQ basis in 1Q 2015, at par with market expectations. In the previous quarter, GDP had climbed 0.30%. Meanwhile, the seasonally adjusted industrial production in the single-currency region unexpectedly dropped 0.30% on a monthly basis in March, compared to a revised rise of 1.00% in the prior month. Market expectations were for it to record a flat reading.

On the other hand, Germany’s seasonally adjusted preliminary GDP advanced less than expected by 0.30% on a quarterly basis in Q1 2015. The nation’s GDP had recorded a rise of 0.70% in the previous quarter.

Other economic data showed that Germany’s final consumer price index remained unchanged on a MoM basis in April, higher than market expectations for a fall of 0.10%. In the prior month, the consumer price index had advanced 0.50%.

In the US, advance retail sales remained flat in April on a monthly basis, compared to a revised advance of 1.10% in the prior month. Markets were anticipating advance retail sales to climb 0.20%.

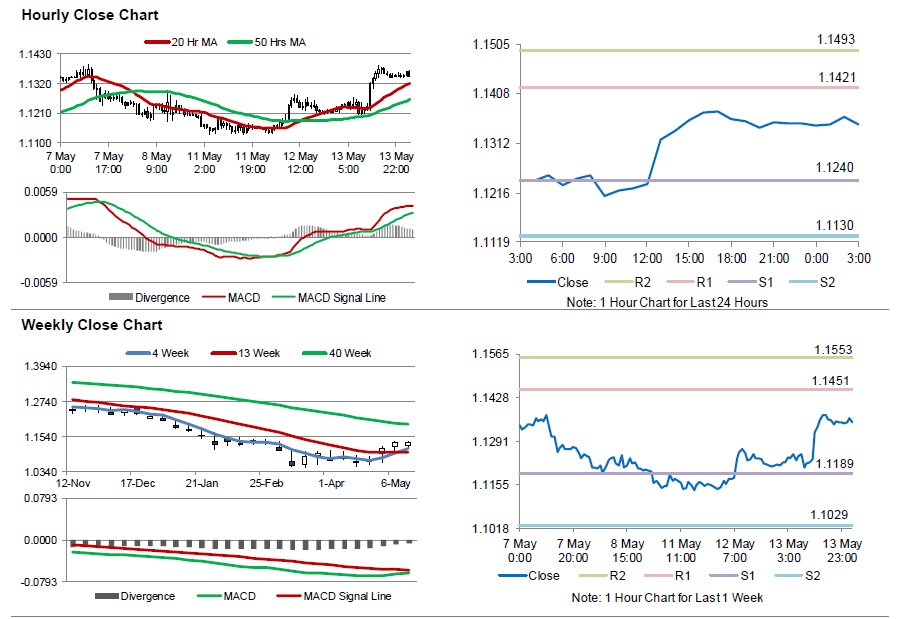

In the Asian session, at GMT0300, the pair is trading at 1.1349, with the EUR trading marginally lower from yesterday’s close.

The pair is expected to find support at 1.1240, and a fall through could take it to the next support level of 1.1130. The pair is expected to find its first resistance at 1.1421, and a rise through could take it to the next resistance level of 1.1493.

Trading trends in the pair today are expected to be determined by the US initial jobless claims data, scheduled later today.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.