For the 24 hours to 23:00 GMT, the EUR rose 0.68% against the USD and closed at 1.1077, reversing its previous session losses.

The greenback lost ground, after the Fed minutes from its latest monetary policy meeting did not deliver any surprise. The minutes revealed that majority of the policymakers felt that the conditions set to warrant a rate hike had not yet been achieved. The minutes also showed that the policymakers expressed concerns about the pace of economic growth outside US, particularly in China and the economic disruption that could result from the Greece debt default.

In other economic news, consumer credit in the US climbed to $16.09 billion in May, compared to a revised advance of $21.40 billion in the prior month, while markets anticipated it to rise to $18.50 billion.

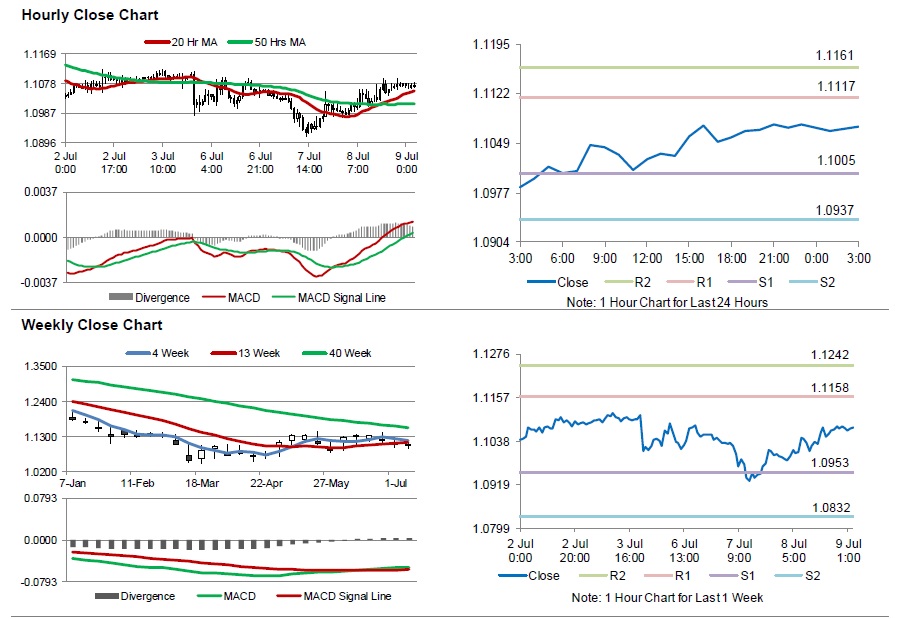

In the Asian session, at GMT0300, the pair is trading at 1.1073, with the EUR trading a tad lower from yesterday’s close.

The pair is expected to find support at 1.1005, and a fall through could take it to the next support level of 1.0937. The pair is expected to find its first resistance at 1.1117, and a rise through could take it to the next resistance level of 1.1161.

Meanwhile, the Greek government will submit its reform proposals to its international creditors today, in order to avert a collapse. Meanwhile, the US initial jobless claims data, scheduled later today would grab lot of market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.