For the 24 hours to 23:00 GMT, the EUR declined 0.07% against the USD and closed at 1.1049, after Germany’s seasonally adjusted trade surplus fell more-than-expected to a level of €21.0 billion in May, following a sharp decline in the nation’s exports, thus indicating that the euro bloc’s largest economy has lost some steam. In the prior month, the nation posted a trade surplus of €25.7 billion while markets expected it to fall to a level of €23.5 billion. Additionally, the nation’s exports unexpectedly eased more-than-anticipated by 1.8% on a monthly basis in May, after recording a gain of 0.1% in the prior month. Meanwhile, the nation’s imports rose less-than-expected by 0.1% MoM in May, compared to a revised drop of 0.3% in the previous month.

In the US, non-farm payrolls climbed by 287.0K in June, increasing the most in 8-months, as manufacturers and other employers boosted hiring. Markets expected it to advance by 180.0K, compared to a revised increase of 11.0K in the prior month. On the other hand, the nation’s unemployment rate rose more-than-expected to 4.9% in June, following a reading of 4.7% in the previous month whereas markets expected it to advance to 4.8%.

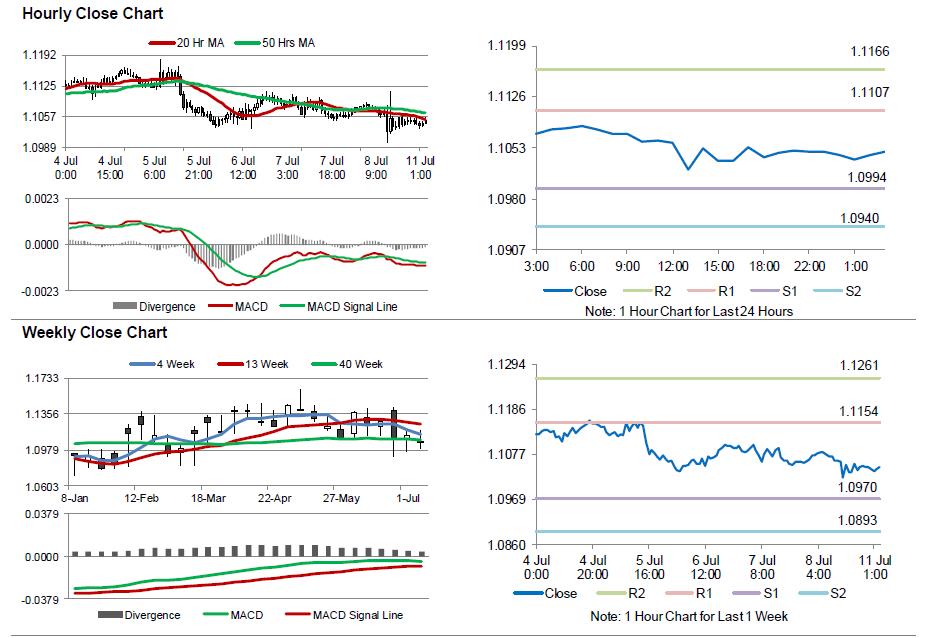

In the Asian session, at GMT0300, the pair is trading at 1.1048, with the EUR trading marginally lower against the USD from Friday’s close.

The pair is expected to find support at 1.0994, and a fall through could take it to the next support level of 1.0940. The pair is expected to find its first resistance at 1.1107, and a rise through could take it to the next resistance level of 1.1166.

With no economic releases in Euro-zone today, investors will look forward to the US labour market conditions index, slated to be released later in the day.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.