For the 24 hours to 23:00 GMT, the EUR rose 0.12% against the USD and closed at 1.1695.

On the data front, the Euro-zone’s M3 money supply grew at a slower than expected pace of 4.0% on a yearly basis in July, compared to an advance of 4.4% in the prior month. Market participants had anticipated the M3 money supply to rise 4.3%.

In the US, data showed that US advance goods trade deficit widened to a level of $72.2 billion in July, higher than market consensus for a rise to a level of $69.0 billion. In the prior month, advance goods balance had registered a revised deficit of $67.9 billion. Meanwhile, the nation’s Richmond Fed manufacturing index unexpectedly rose to a level of 24.0 in August, defying market expectations for a drop to a level of 17.0. In the preceding month, the index had recorded a reading of 20.0. Additionally, the CB consumer confidence index surprisingly jumped to an 18-month high level of 133.4 in August, compared to a revised reading of 127.9 in the prior month, while market participants had envisaged the index to ease to a level of 126.6.

In the Asian session, at GMT0300, the pair is trading at 1.1691, with the EUR trading slightly lower against the USD from yesterday’s close.

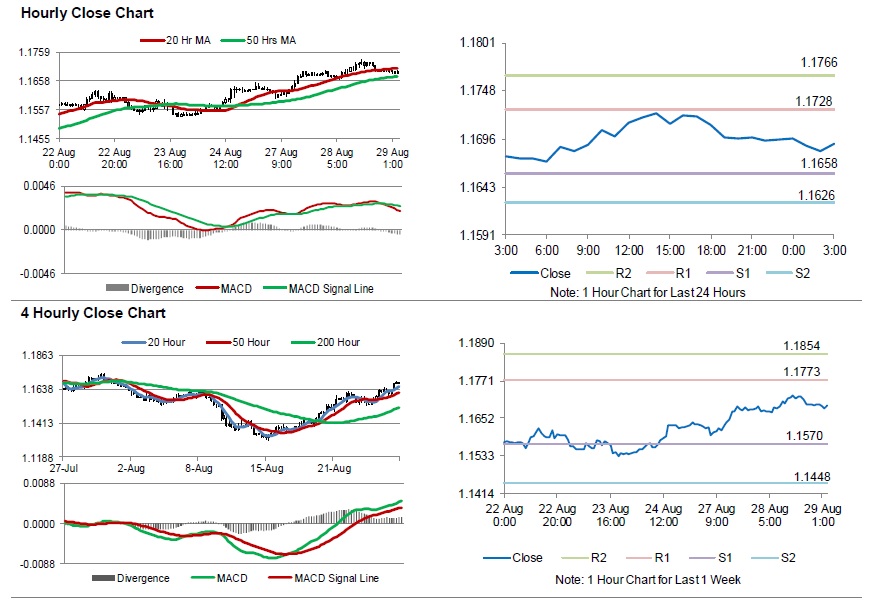

The pair is expected to find support at 1.1658, and a fall through could take it to the next support level of 1.1626. The pair is expected to find its first resistance at 1.1728, and a rise through could take it to the next resistance level of 1.1766.

Moving ahead, traders will keep an eye on Germany’s Gfk consumer confidence index for September, set to release in a while. Later in the day, the US GDP data for 2Q and pending home sales data for July along with the MBA mortgage applications, will keep investors on their toes.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.