For the 24 hours to 23:00 GMT, the EUR declined 0.11% against the USD and closed at 1.1736.

In the economic news, Euro-zone’s ZEW economic sentiment index eased to -18.70 in July, following a reading of -12.60 in the prior month.

Additionally, in Germany, the ZEW current situation index fell more-than-expected to a level of 72.40 in July. The current situation index had recorded a level of 80.60 in the previous month. The ZEW economic sentiment index dropped to -24.70 in July, compared to a level of -16.10 in the prior month.

In the US, the NFIB small business optimism index dropped to a level of 107.2 in June, compared to market expectations of a fall to a level of 106.9. The index had recorded a reading of 107.8 in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.1731, with the EUR trading slightly lower against the USD from yesterday’s close.

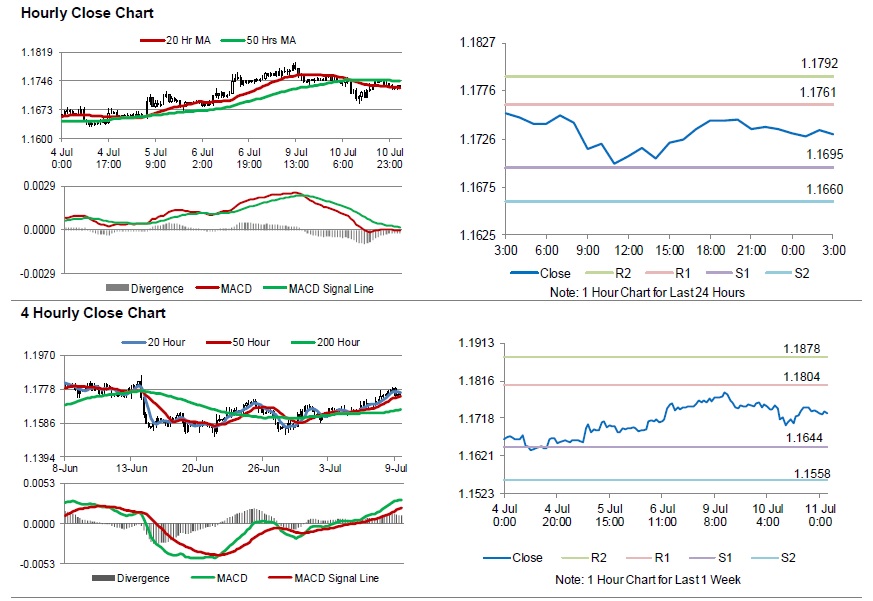

The pair is expected to find support at 1.1695, and a fall through could take it to the next support level of 1.1660. The pair is expected to find its first resistance at 1.1761, and a rise through could take it to the next resistance level of 1.1792.

Looking ahead, investors will closely monitor the European Central Bank (ECB) President, Mario Draghi speech, due in a while. Later in the day, the US producer price index, for June, will keep investors on their toes.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.