For the 24 hours to 23:00 GMT, the EUR declined 0.07% against the USD and closed at 1.3681, as the latest batch of soft economic releases from the Euro-zone and its member nations spurred fresh concerns on the recovery-prospects of the economy.

Data showed that Euro-zone’s final Markit manufacturing PMI fell to a seven-month low reading of 51.8 in June, from previous month’s level of 52.2 and compared to flash estimates of 51.9. Likewise, final reading of Markit PMI for German, French and Italian manufacturing sectors declined for month of June. However, unemployment rate in the Euro-zone economy defied market expectations for a rise to 11.7% in May by remaining unchanged at previous month’s level of 11.6%. Similarly, unemployment in Germany, Euro-zone’s largest economy, stood pat at a seasonally adjusted rate of 6.7% in June even as the number of jobless people in the nation rose by a seasonally adjusted 9,000 numbers to 2.916 million in June.

Meanwhile, in the US, the ISM manufacturing PMI unexpectedly eased to a reading of 55.3 in June from a level of 55.4 in May, while the final Markit manufacturing PMI for the US economy came in at a reading of 57.3 in June, the highest level since May 2010. In other US economic news, the Commerce Department reported that construction spending in the world’s largest economy edged up 0.1% (MoM) to an annual rate of $956.1 billion in May.

In the Asian session, at GMT0300, the pair is trading at 1.3678, with the EUR trading marginally lower from yesterday’s close.

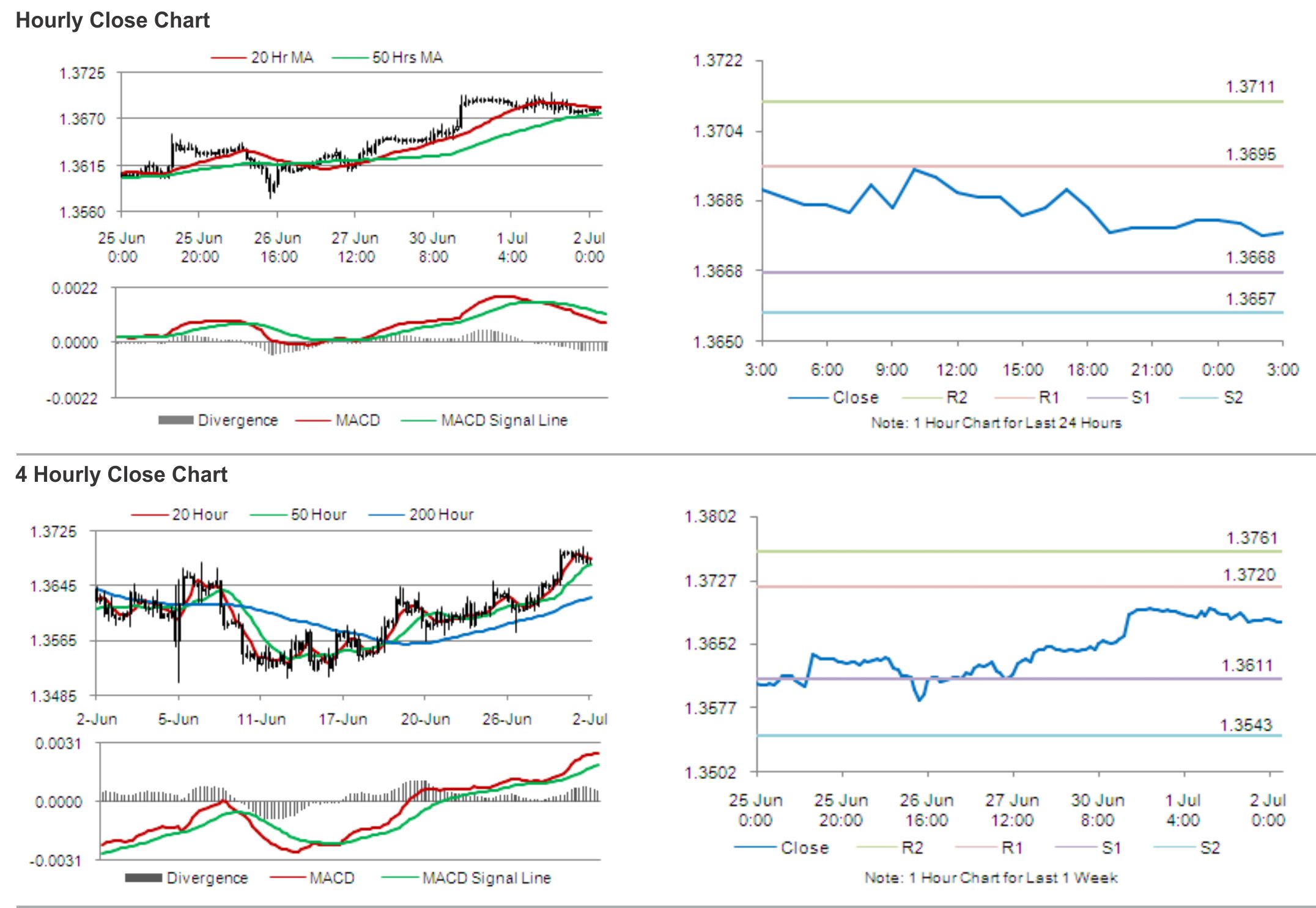

The pair is expected to find support at 1.3668, and a fall through could take it to the next support level of 1.3657. The pair is expected to find its first resistance at 1.3695, and a rise through could take it to the next resistance level of 1.3711.

During the later course of the day, traders would keenly eye Euro-zone’s first-quarter GDP data for further cues in the Euro, while greenback traders would await a planned speech from Fed Chief, Janet Yellen, before taking any major bets in the US Dollar.

The currency pair is trading just below its 20 Hr moving average and is showing convergence with its 50 Hr moving averages.