On Friday, the EUR declined 0.61% against the USD and closed at 1.3755, extending its previous day’s losses on the back of the ECB President, Mario Draghi’s comments on loose monetary policy.

In the Euro-zone, an ECB Governing Council member, Erkki Liikanen, supported the ECB President, Draghi’s Thursday’s comments by stating that his views on additional stimulus measures in the region reflected the central bank’s “common view.” Separately, data from Euro-zone’s member nations showed that Germany’s seasonally adjusted trade surplus unexpectedly narrowed to €14.8 billion in March as exports in the nation fell 1.8% (MoM) in March, while imports declined 0.9% from February. Likewise, industrial production in Italy posted a surprise fall for the second consecutive month in March, largely due to a decline in output of consumer goods and energy production.

In a noteworthy development, Moody’s upgraded Portugal’s government bond rating to “Ba2” from “Ba3” and hinted that a further rating upgrade could follow in the upcoming months. Separately, the S&P’s, citing an upbeat improvement in the nation’s economic and budgetary performance, revised its outlook on Portugal’s “BB” sovereign rating to “Stable” from “Negative.”

Meanwhile, in the US, the Dallas Fed President, Richard Fisher highlighted his support for the central bank to end its stimulus programme in October with a final reduction of $15.0 billion. Furthermore, he opined that interest rate in the nation could remain near the zero level for some more time in the future if inflation rate does not rise above the central bank’s target of 2.0%. Separately, at a business conference in Dubai, the Atlanta Fed President, Dennis Lockhart, projected the world’s largest economy to register an annual growth of 3.0% or more in the second quarter of 2014 while expressing concern on the sustainability of growth. Additionally, he indicated that the US Fed could use a reverse-repurchase programme to influence short-term interest rates while it began to end its stimulus measures.

In the Asian session, at GMT0300, the pair is trading at 1.3755, with the EUR trading flat from Friday’s close, ahead of few planned speeches by the ECB officials, Vitor Constancio and Ewald Nowotny.

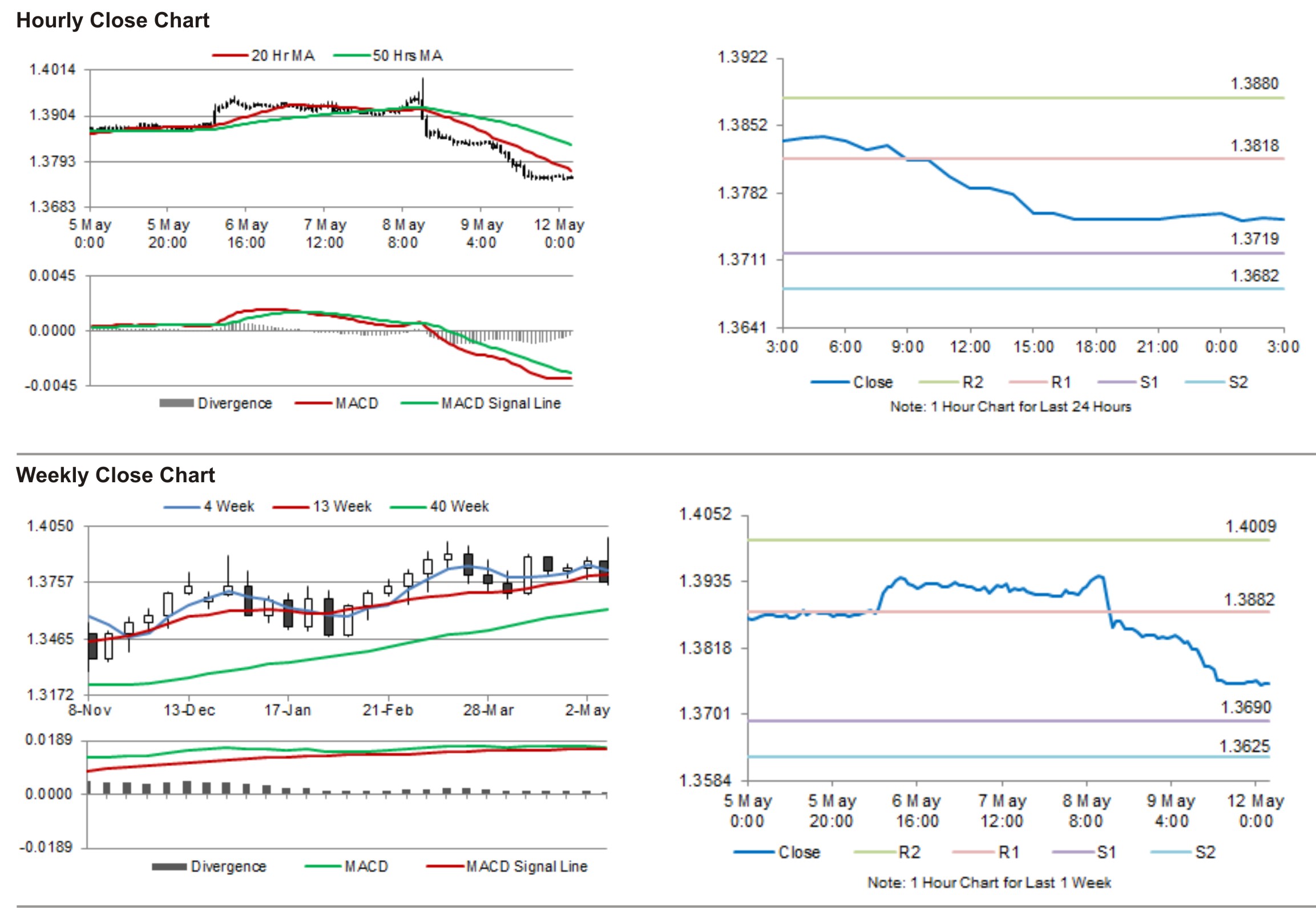

The pair is expected to find support at 1.3719, and a fall through could take it to the next support level of 1.3682. The pair is expected to find its first resistance at 1.3818, and a rise through could take it to the next resistance level of 1.3880.

Amid lack of economic releases in the Euro-zone, traders would eye few planned speeches from the ECB and the US Fed officials, for further cues in the currency pair.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.