For the 24 hours to 23:00 GMT, the EUR declined 0.42% against the USD and closed at 1.1137.

On the data front, Italy’s final consumer price index rose by 0.2% MoM in July, in line with market expectations and following a similar gain in the previous month.

Elsewhere, in the US, data indicated that initial jobless claims dropped to a level of 266.0K during the week ended 06 August, indicating that the nation’s labour market continues to gain momentum. Markets expected it to fall to a level of 265.0K, after recording a revised level of 267.0K in the previous week. Additionally, the nation’s import price index unexpectedly rose by 0.1% on a monthly basis in July, compared to a revised advance of 0.6% in the prior month while markets expected the index to fall by 0.4%. Also, the nation’s export price index rose by 0.2% MoM in July, following a gain of 0.8% in the preceding month.

In the Asian session, at GMT0300, the pair is trading at 1.1137, with the EUR trading flat against the USD from yesterday’s close.

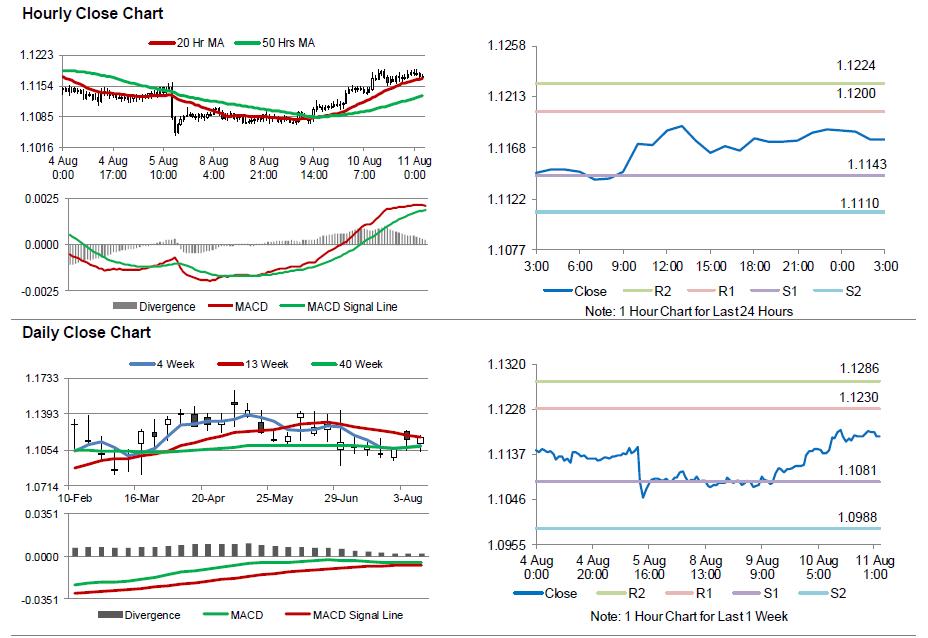

The pair is expected to find support at 1.1115, and a fall through could take it to the next support level of 1.1094. The pair is expected to find its first resistance at 1.1170, and a rise through could take it to the next resistance level of 1.1204.

Ahead in the day, traders would closely monitor Q2 flash GDP figures for Eurozone as well as Germany. Eurozone’s industrial production as well as Germany’s consumer prices data, set for release today, would also garner market attention. Additionally, in the US, advance retail sales and Michigan confidence index data, due to release later today, would also keep the investors on their toes.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.