For the 24 hours to 23:00 GMT, the EUR declined 0.35% against the USD and closed at 1.0929.

In economic news, the flash consumer price index in Germany rose 0.10% on a monthly basis in May, at par with market expectations, suggesting that the ECB’s massive monetary stimulus measures were succeeding in pushing up consumer prices in Europe’s biggest economy.

Other economic data showed that Germany’s final manufacturing PMI dropped to 51.10 in May, compared to a level of 52.10 in the previous month, while markets were anticipating it to ease to 51.40. Meanwhile, the Euro-zone’s final manufacturing PMI climbed to 52.20 in May, compared to market expectations of an advance to 52.30.

The greenback traded on a stronger footing, as manufacturing activity in the US expanded at a faster pace than expected in May, easing concerns over the health of the economy.

Data released showed that the nation’s ISM manufacturing index rose to a three-month high of 52.8 in May, from a reading of 51.5 in April. Analysts had expected the manufacturing PMI to edge up to 52.0 in May. Additionally, personal income in the US advanced 0.40% in April on a MoM basis, higher than market expectations for a rise of 0.30%.

Other economic data showed that, final Markit manufacturing PMI in the US fell to a level of 54.00 in May, compared to a level of 54.10 in the prior month.

Separately, the Boston Fed President, Eric Rosengren opined that the nation’s economy was growing too slow to justify an interest rate hike. He stated that the conditions laid down for implementing the rate hike have not yet been met and the Fed should continue to be patient with monetary policy to ensure that the US economy gets back on track.

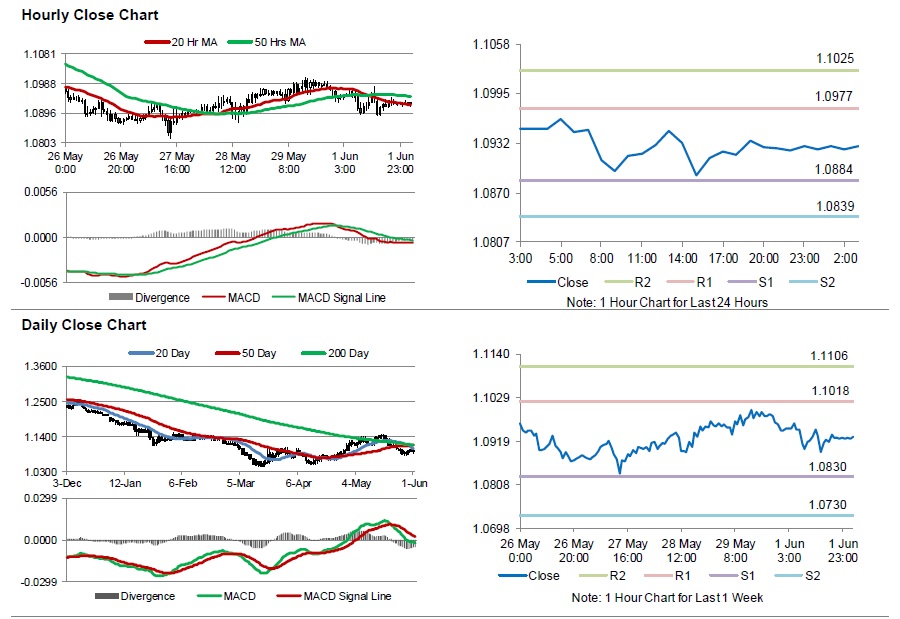

In the Asian session, at GMT0300, the pair is trading at 1.0929, with the EUR trading flat higher from yesterday’s close.

The pair is expected to find support at 1.0884, and a fall through could take it to the next support level of 1.0839. The pair is expected to find its first resistance at 1.0977, and a rise through could take it to the next resistance level of 1.1025.

Trading trends in the Euro today are expected to be determined by the Euro-zone’s inflation as well as Germany’s unemployment data, scheduled in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.