For the 24 hours to 23:00 GMT, the EUR rose 0.06% against the USD and closed at 1.1353, after the Euro-zone’s Sentix investor confidence index advanced above expectations to a level of 9.9 in June, from a reading of 6.2 in the previous month. Investors had expected it to register a reading of 7.0. On the other hand, seasonally adjusted German factory orders declined more-than-expected by 2.0% MoM in April, its largest monthly drop since July 2015, mainly led by a heavy drop in demand from non-Euro-zone countries. Factory orders had risen by a revised 2.6% in the prior month.

The greenback lost ground after, the US Federal Reserve Chairwoman, Janet Yellen, indicated that an interest rate increase is on the way, but stopped short of allotting a timeframe for the same. She further stated that investors should not overreact to last week’s disappointing US jobs report and assured that she expects the positive economic forces will eventually outweigh the negatives.

In other economic news, the US labour market conditions index fell for the fifth consecutive month to a level of -4.8 in May, its lowest level since May 2009 and after registering a reading of -3.4 in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.1353, with the EUR trading flat against the US Dollar from yesterday’s close.

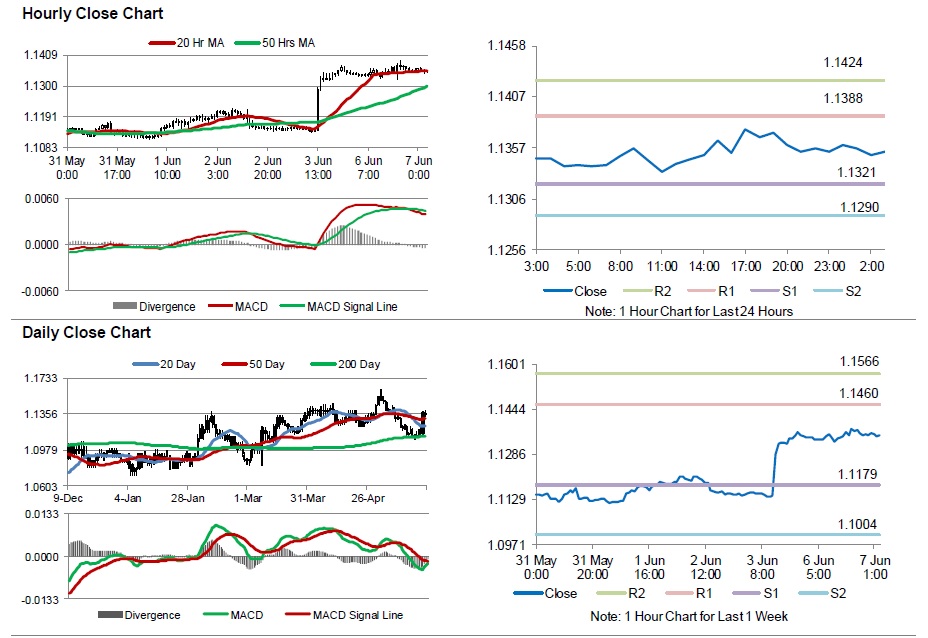

The pair is expected to find support at 1.1321, and a fall through could take it to the next support level of 1.1290. The pair is expected to find its first resistance at 1.1388, and a rise through could take it to the next resistance level of 1.1424.

Going ahead, market participants will look forward to Germany’s industrial production data for April and the Euro-zone’s final Q1 GDP data, scheduled to release in a few hours. Moreover, the US IBD/TIPP economic optimism index and consumer credit change data, due later today, will also attract investor attention.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.