For the 24 hours to 23:00 GMT, the EUR declined 0.71% against the USD and closed at 1.2384, after the Euro-zone’s producer price index retreated 0.4% on a monthly basis in October, worse than expected decline of 0.3% and compared to a rise of 0.2% in the prior month, thus highlighting concerns that the common-currency region still remained under a threat of deflation.

Elsewhere, in Spain, the number of unemployed people unexpectedly dropped by 14.7 K in November, compared to an increase of 79.2 K in the previous month.

In the US, the New York City current business condition index surged to 62.4 in November, from 54.8 in October, while markets were expecting it to advance to a level of 55.0. Meanwhile, the nation’s construction spending rebounded 1.1% on a monthly basis in October, beating market expectations for a 0.6% gain and compared to a drop of 0.1% recorded in September. On the other hand, the seasonally adjusted Redbook index eased 0.6% on a MoM basis in the week ended 28 November 2014. The index had fallen 0.8% in the prior week.

Separately, the Fed Vice Chairman, Stanley Fischer, cautioned that a decline in the US consumer prices would compel the central bank to delay interest rate hike. However, at the same time, he hinted that the Fed might soon get rid of its forward guidance language that interest rates in the nation would remain close to zero for a “considerable time”.

In the Asian session, at GMT0400, the pair is trading at 1.2384, with the EUR trading flat from yesterday’s close.

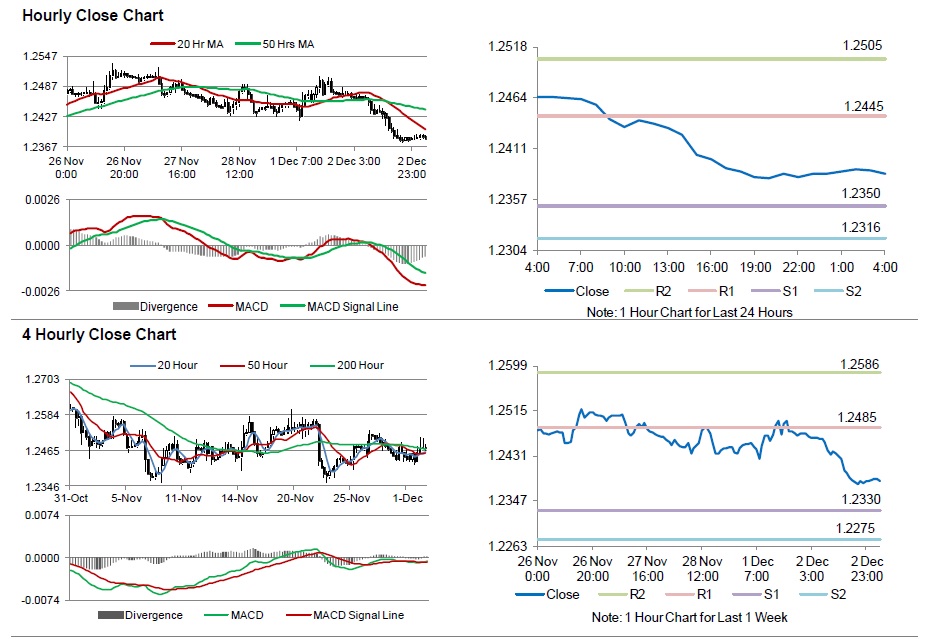

The pair is expected to find support at 1.2350, and a fall through could take it to the next support level of 1.2316. The pair is expected to find its first resistance at 1.2445, and a rise through could take it to the next resistance level of 1.2505.

Trading trends in the Euro today are expected to be determined by the Euro-zone’s services PMI coupled with retail sales data, scheduled in a few hours. Additionally, the US ISM non-manufacturing composite data would grab lot of market attention, scheduled later today.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.