For the 24 hours to 23:00 GMT, the EUR rose 0.63% against the USD and closed at 1.2918.

Yesterday, the ECB in its first of eight Targeted Long Term Refinancing Operations (TLTROs) to be carried out between 2014 and 2016, allocated €82.6 billion to 255 counterparties at a fixed interest rate of 0.15%, less than market consensus for an allotment of €150.0 billion.

Elsewhere, in Italy, the current account surplus expanded to €6.81 billion in July, from a surplus of €3.05 billion registered in the prior month.

In the US, number of initial jobless claims registered a drop to 280K in the week ended 13 September 2014, marking its lowest level since July, beating market expectations to drop to a level of 305K and compared to a revised reading of 316K in the prior week, while continuing jobless claims in the nation dropped to 2,429K in the week ended 06 September 2014, compared to market expectations for a reading of a fall to 2466.0 K and following a revised reading of 2,492K in the preceding week. On the other hand, the building permits issues in the US fell significantly more than expected, on a monthly basis, in August to 998K units from previous month’s 1,057K units. Analysts expected building permits to fall to 1,045K units. Meanwhile, the housing starts as well came in below forecasts for a similar period at a pace of 956K. Additionally, the Philadelphia Fed’s index of general business activity eased to 22.5 in September, after registering a reading of 28.0 in August, its highest level since March 2011.

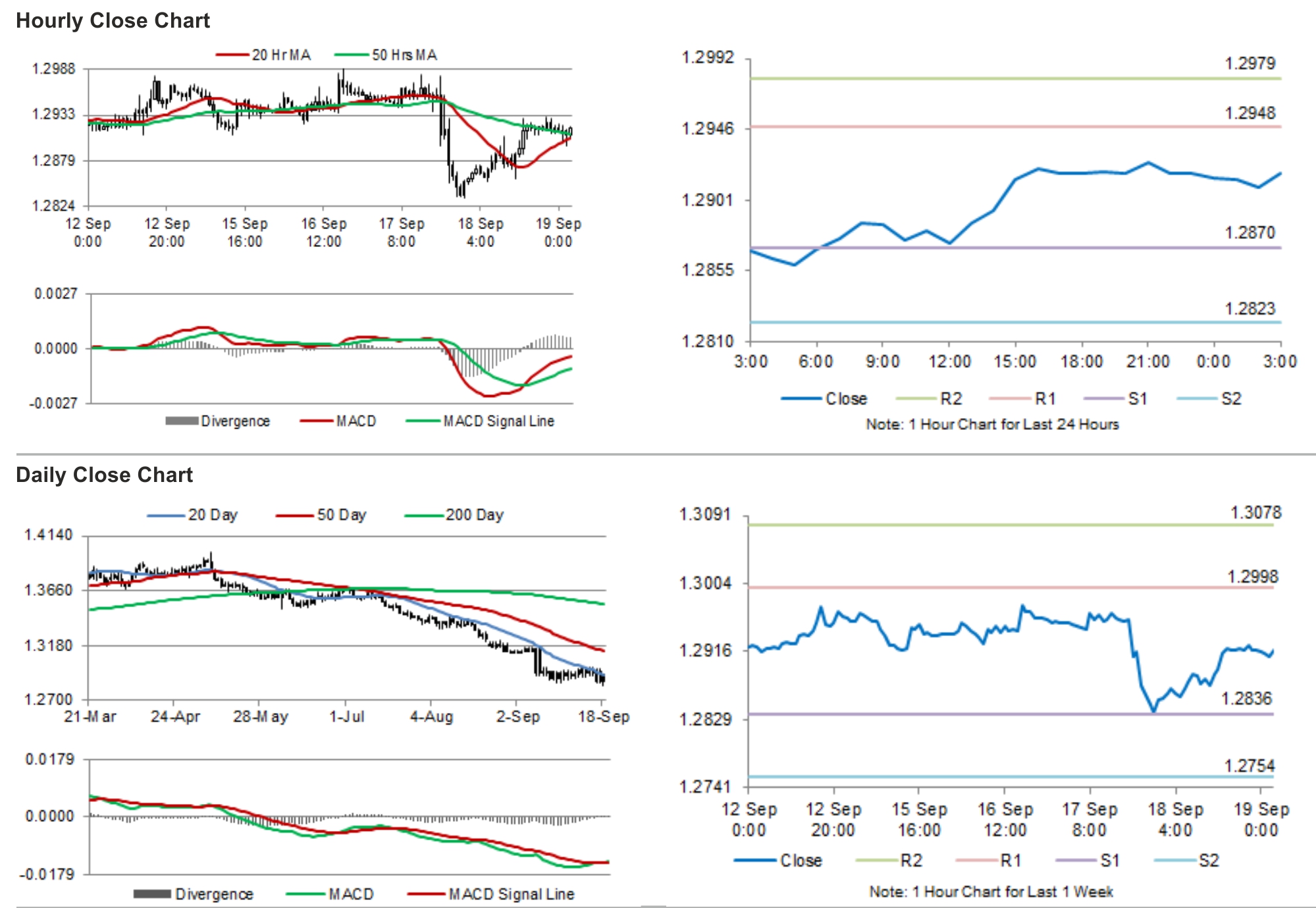

In the Asian session, at GMT0300, the pair is trading at 1.2918, with the EUR trading flat from yesterday’s close.

The pair is expected to find support at 1.287, and a fall through could take it to the next support level of 1.2823. The pair is expected to find its first resistance at 1.2948, and a rise through could take it to the next resistance level of 1.2979.

Going forward, investors would look forward to the release of the CB Leading Indicator from the US.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.