For the 24 hours to 23:00 GMT, the EUR rose 0.27% against the USD and closed at 1.0769, following stronger than expected economic data in the Euro-zone and its peripheries.

Data showed that Germany’s final Markit manufacturing PMI rose to a 10-month high level of 52.80 in March, beating market expectations of an advance to a level of 52.40, while the Euro-zone’s manufacturing PMI climbed more than expected to a level of 52.2 in March, from prior month’s reading of 51.9, thus indicating a positive economic outlook for the European economy.

The Euro was further supported, after manufacturing PMI in Italy jumped to an 11-month high of 53.3 in March, compared to previous month’s level of 51.9. Markets were expecting it to rise to a level of 52.1.

The greenback lost ground, after the US ISM manufacturing activity index recorded a drop to 51.50 in March, compared to a reading of 52.90 in the prior month. Markets were anticipating the index to drop to a level of 52.50. Additionally, private sector employment in the nation climbed by 189.00 K in March, following a revised gain of 214.00 K in the previous month. Markets were anticipating it to advance by 225.00 K.

On the other hand, the final Markit manufacturing PMI advanced to 55.70 in March. Market expectations were for it to advance to a level of 55.30.

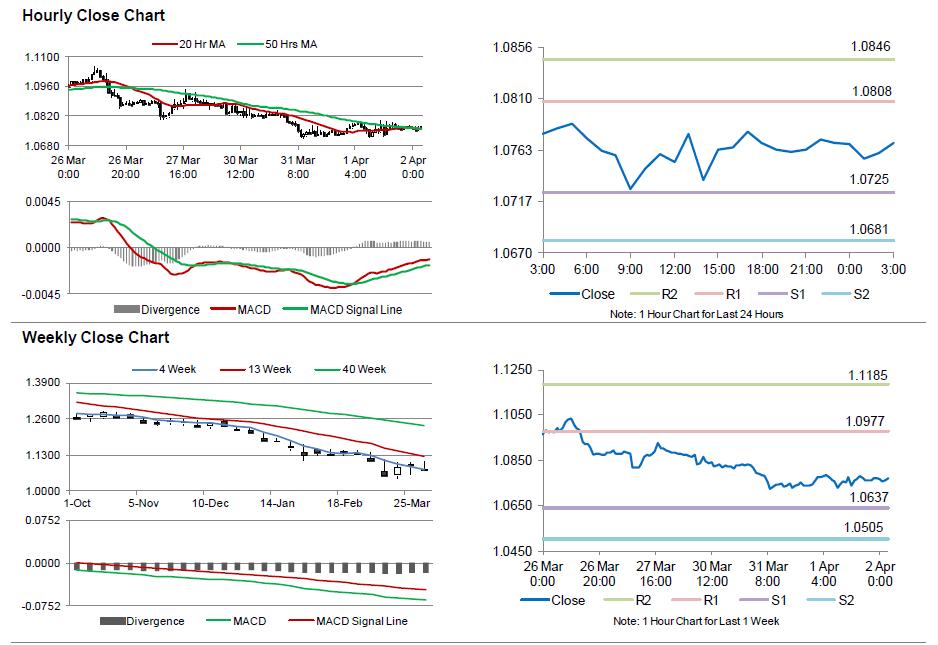

In the Asian session, at GMT0300, the pair is trading at 1.077, with the EUR trading flat from yesterday’s close.

The pair is expected to find support at 1.0725, and a fall through could take it to the next support level of 1.0681. The pair is expected to find its first resistance at 1.0808, and a rise through could take it to the next resistance level of 1.0846.

Amid no economic releases in the Euro-zone today, trading trends in the pair would be determined by economic releases in the US, scheduled later today.

The currency pair is trading slightly below its 20 Hr and 50 Hr moving averages.