For the 24 hours to 23:00 GMT, the EUR declined 0.24% against the USD and closed at 1.1075, despite a rise in the seasonally adjusted trade surplus in the Eurozone to €21.90 billion in June, following a revised surplus of €21.30 billion in the previous month. However, it was below its market expectations of a trade surplus worth €23.10 billion.

The USD gained ground after the housing market index in August rose to 61.00 in the US, in-line with market expectations. The index had registered a reading of 60.00 in the previous month. Meanwhile, the NY Empire State manufacturing index unexpectedly swung to negative territory, falling to -14.92 in August, significantly worse than market expectations of a rise to 4.50. In the prior month, the index had registered a level of 3.86.

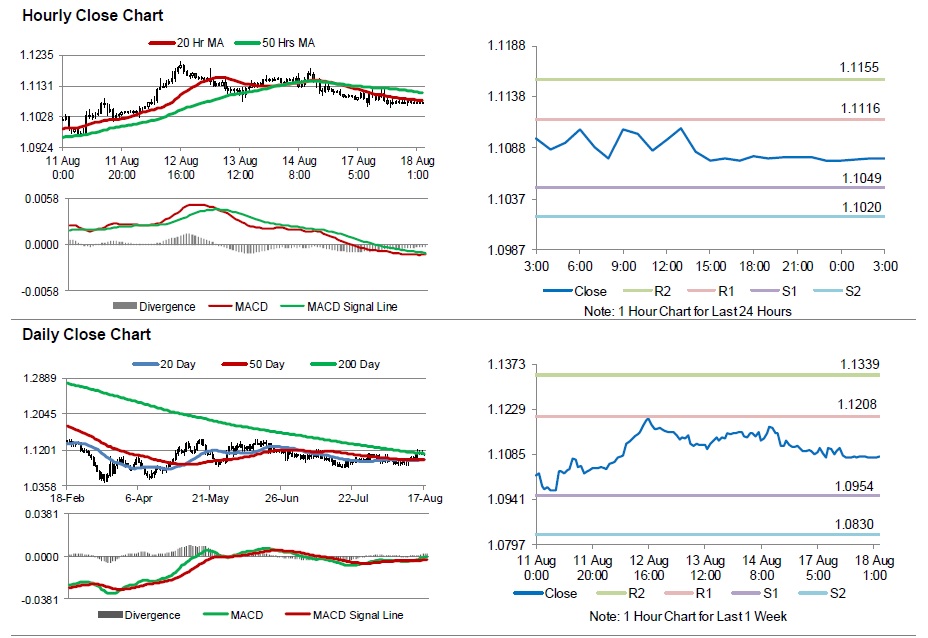

In the Asian session, at GMT0300, the pair is trading at 1.1078, with the EUR trading marginally higher from yesterday’s close.

The pair is expected to find support at 1.1049, and a fall through could take it to the next support level of 1.102. The pair is expected to find its first resistance at 1.1116, and a rise through could take it to the next resistance level of 1.1155.

Trading trends in the EUR today are expected to be determined by current account as well as construction output for June, slated to release in a few hours. Housing starts and building permits data from the US would also be keenly awaited by the market participants.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.