For the 24 hours to 23:00 GMT, the EUR declined 0.38% against the USD and closed at 1.0652.

In economic news, Italy’s seasonally adjusted industrial production dropped more-than-expected by 2.3% on a monthly basis in January, declining for the first time in four months and casting fresh doubts on the health of the nation’s industrial sector. Meanwhile, market participants anticipated a fall of 0.8%, following a rise of 1.4% in the previous month.

In the Asian session, at GMT0400, the pair is trading at 1.0652, with the EUR trading flat against the USD from yesterday’s close, as investors await the Dutch elections, scheduled tomorrow.

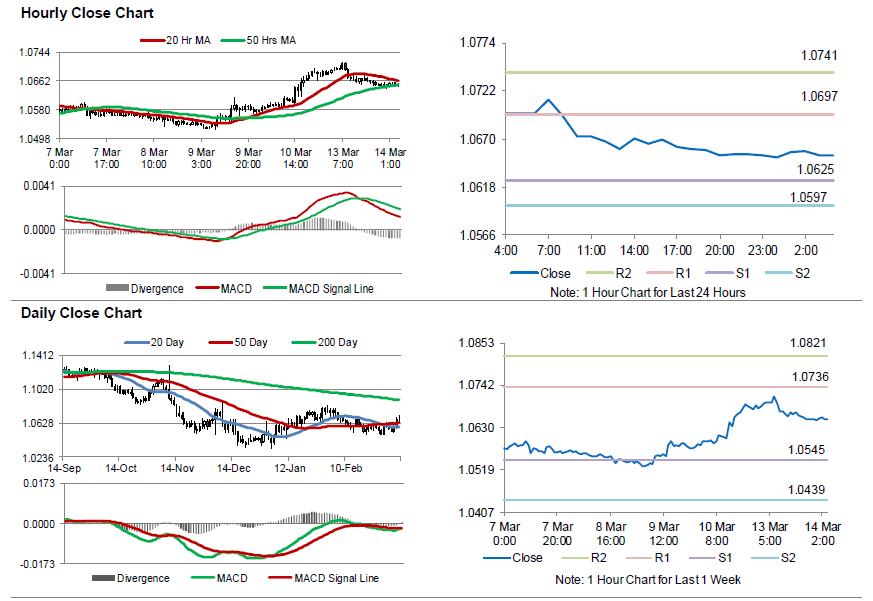

The pair is expected to find support at 1.0625, and a fall through could take it to the next support level of 1.0597. The pair is expected to find its first resistance at 1.0697, and a rise through could take it to the next resistance level of 1.0741.

Trading trend in the Euro today is expected to be determined by release of the ZEW survey of economic sentiment index for March across the Euro-zone along with the Euro-zone’s industrial production for January and Germany’s final inflation figures for February, scheduled to release in a few hours. Moreover, the US NFIB small business optimism index for February will also be keenly watched by investors.

The currency pair is trading below its 20 Hr moving average and showing convergence with its 50 Hr moving average.