For the 24 hours to 23:00 GMT, the EUR declined 0.57% against the USD and closed at 1.1788.

In economic news, Germany’s import price index remained flat on a monthly basis in August, compared to market consensus for an advance of 0.1%. The index had registered a drop of 0.4% in the previous month.

The US Dollar advanced against its major peers, after remarks from the US Federal Reserve (Fed) Chair, Janet Yellen, strengthened the case of a December interest rate hike.

The Fed Chief admitted that officials may have misjudged the labour market strength and the fundamental forces driving inflation and that downward pressures on inflation could prove to be unexpectedly persistent. However, Yellen outlined the need to continue gradual interest rate hikes and warned that policymakers should also be wary of moving too gradual to avoid the risk of overheating of the economy.

Separately, data released in the US showed that the CB consumer confidence index dropped more-than-expected to a level of 119.8 in September, from a revised five-month high level of 120.4 in the prior month, as concerns over the impact of Hurricanes Harvey and Irma weighed on investor sentiment. Meanwhile, markets were anticipating the index to drop to a level of 120.0. Further, the nation’s new home sales unexpectedly eased 3.4% on monthly basis to a level of 560.0K in August, dipping to an eight-month low, as Hurricanes Harvey and Irma affected sales. Market participants had envisaged for a rise to a level of 585.0K, after recording a revised reading of 580.0K in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.1788, with the EUR trading flat against the USD from yesterday’s close.

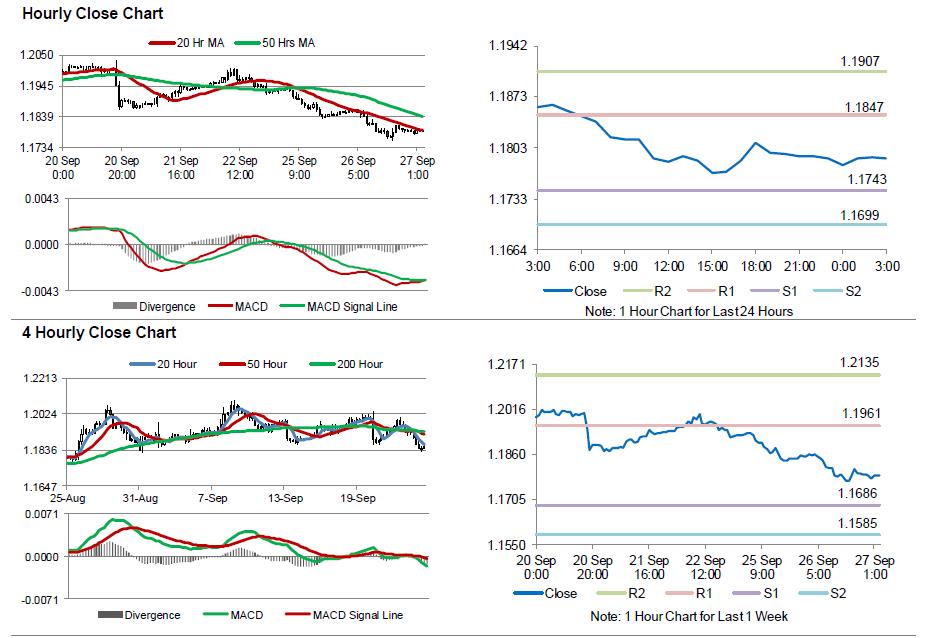

The pair is expected to find support at 1.1743, and a fall through could take it to the next support level of 1.1699. The pair is expected to find its first resistance at 1.1847, and a rise through could take it to the next resistance level of 1.1907.

Amid no macroeconomic releases in the Euro-zone today, investors will draw their attention to the US flash durable goods orders and pending home sales data, both for August, along with mortgage applications data, all slated to release later in the day.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.