For the 24 hours to 23:00 GMT, EUR rose 0.08% against the USD and closed at 1.3327.

However, gains in euro were limited after the European Central Bank (ECB) failed to fully offset its purchases of Euro-zone government bonds, highlighting growing tensions in European banking system.

Italy’s borrowing costs rose sharply as it sold a total of €7.5 billion of a new three-year benchmark and other government bonds yesterday. Of these three-year bonds, €3.5 billion were sold at a euro-era record-high yield of 7.89%.

In economic news, the Economic Sentiment Index in the Euro-zone declined to 93.7 in November, compared to 94.8 in October. Industrial Confidence Index fell to -7.3 in November, compared to -6.5 in the previous month. Additionally, Consumer Confidence Index slipped to -20.4 in November, compared to -19.9 in the previous month.

In the Asian session, at GMT0400, the pair is trading at 1.3326, with the EUR trading flat from yesterday’s close.

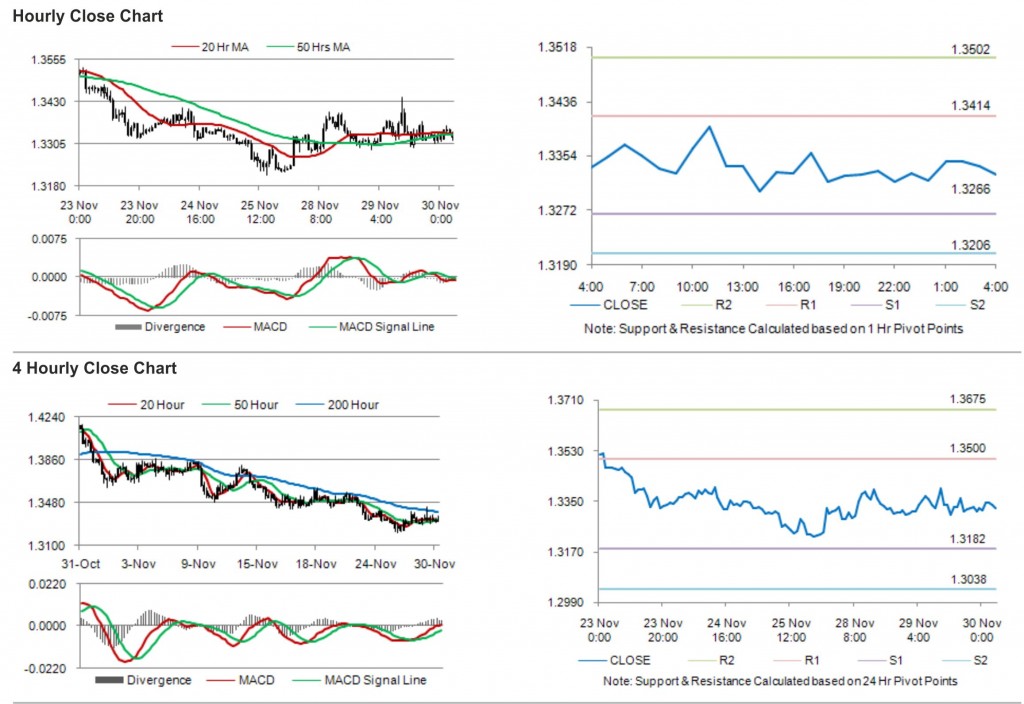

The pair is expected to find support at 1.3266, and a fall through could take it to the next support level of 1.3206. The pair is expected to find its first resistance at 1.3414, and a rise through could take it to the next resistance level of 1.3502.

Trading trends in the pair today are expected to be determined by data release on retail sales in Germany and Unemployment Rate in the Euro-zone.

The currency pair is trading just below its 20 Hr and 50 Hr moving averages.