For the 24 hours to 23:00 GMT, the EUR rose 0.45% against the USD and closed at 1.0704 on Friday.

In economic news, Germany’s producer price index rose 1.0% on a monthly basis in December, in line with market expectations and notching its highest level in four-years. The index had climbed 0.1% in the prior month.

The greenback lost ground against its key counterparts, amid rising concerns among investors after Donald Trump took a protectionist tone in his first speech as the US President.

Meanwhile, the Philadelphia Federal Reserve President, Patrick Harker, expressed optimism over the US economic growth, inflation and the labour market and reiterated that if the economy stays on growth-track, three interest rate hikes would be appropriate in 2017.

In the Asian session, at GMT0400, the pair is trading at 1.0743, with the EUR trading 0.36% higher against the USD from Friday’s close.

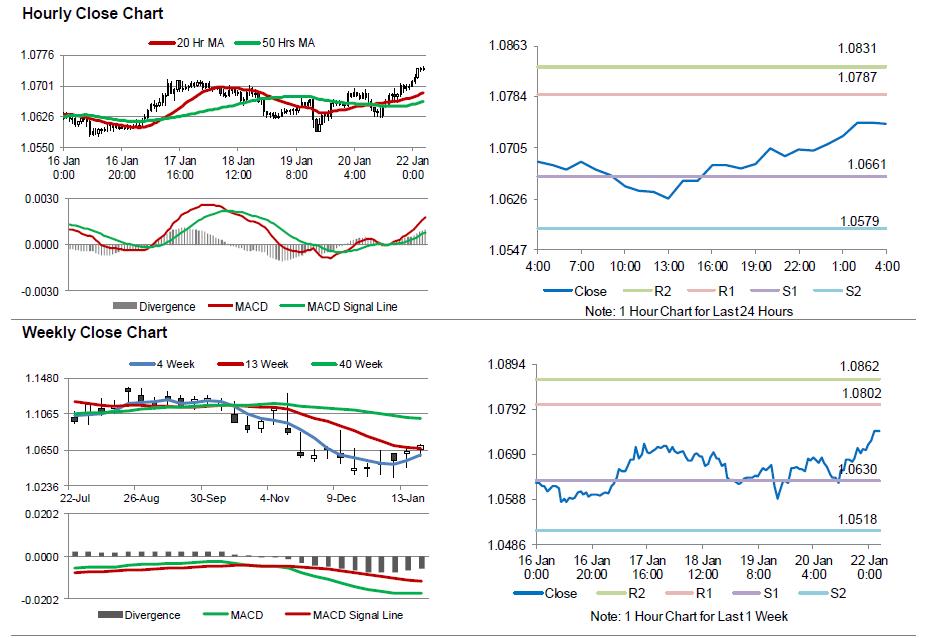

The pair is expected to find support at 1.0661, and a fall through could take it to the next support level of 1.0579. The pair is expected to find its first resistance at 1.0787, and a rise through could take it to the next resistance level of 1.0831.

Moving ahead, investors will look forward to a speech by the ECB President, Mario Draghi along with the Euro-zone’s preliminary consumer confidence index for January, scheduled to release later today. Additionally, the German Buba monthly report, slated to release in a few hours, will also be on investor’s radar.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.