For the 24 hours to 23:00 GMT, the EUR rose 0.19% against the USD and closed at 1.3193, despite the German Gfk consumer confidence unexpectedly eased in September for the first time in more than one and a half years, highlighting escalated geopolitical tensions in the Middle East, Eastern Ukraine as well as the trade sanctions imposed on Russia, which had a negative impact on the German economy. The Gfk consumer sentiment indicator fell to 8.6 in September, from 8.9 in August. Separately, Germany’s import price index fell more than expected, easing 0.4%, on a monthly basis in July, beating market expectations for a drop of 0.1%. Meanwhile, the industrial business climate index in France surprisingly dropped to 91.0 in August, compared to market expectations for a rise to a level of 96.0. Elsewhere, Italy’s consumer morale showed deteriorating signs for August.

Meanwhile, the German Finance Minister, Wolfgang Schaeuble, in an interview, said that the comments made by the ECB Chief, Mario Draghi, at the Jackson Hole, were “over-interpreted”, raising concerns that the central bank may not be as close to introducing additional stimulus measures as previously indicated.

In the US, the applications for US home mortgages rose 2.8% in the week ended August 22, compared to a rise of 1.4%, registered in the prior week.

In the Asian session, at GMT0300, the pair is trading at 1.3213, with the EUR trading 0.15% higher from yesterday’s close.

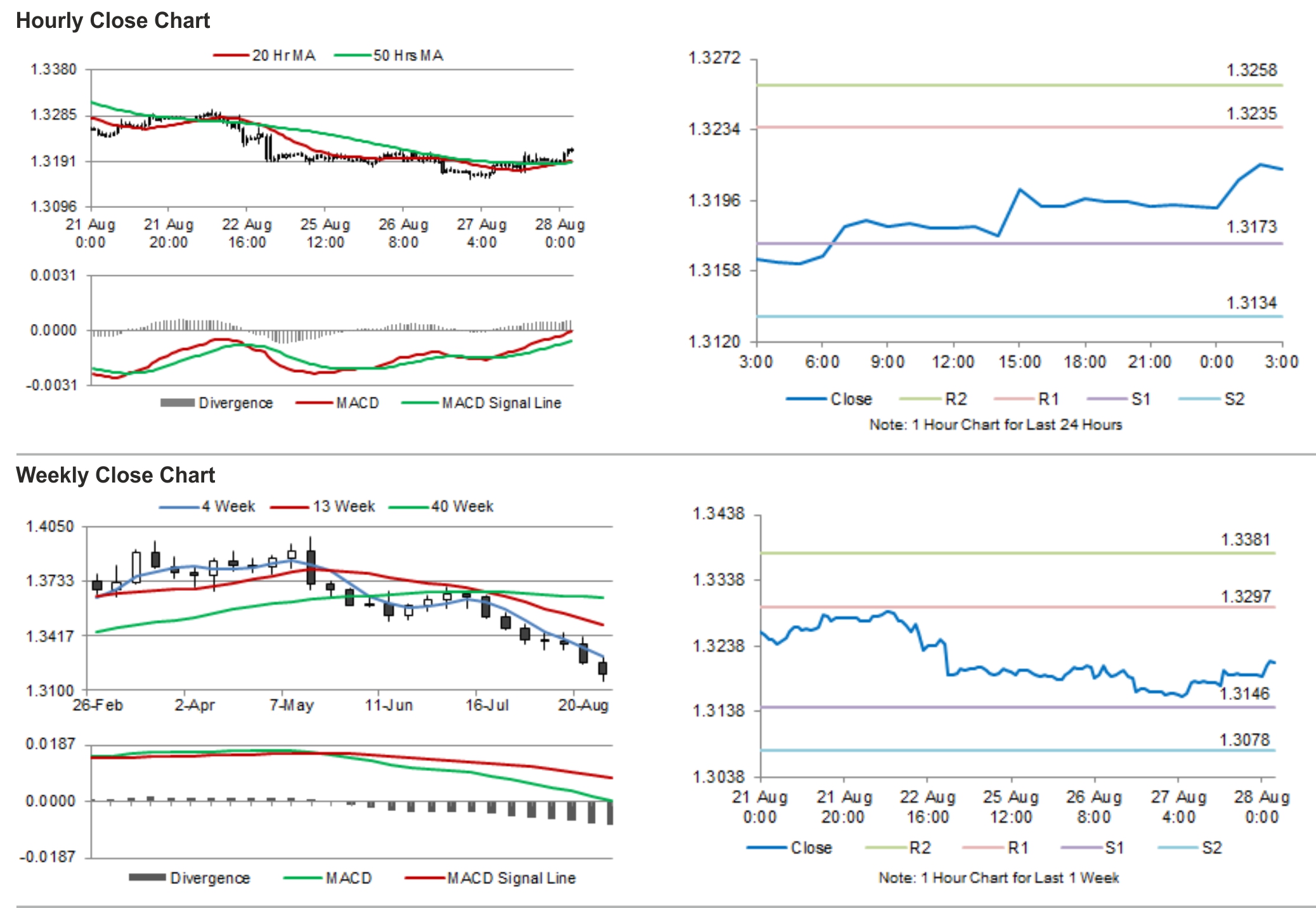

The pair is expected to find support at 1.3173, and a fall through could take it to the next support level of 1.3134. The pair is expected to find its first resistance at 1.3235, and a rise through could take it to the next resistance level of 1.3258.

Trading trends in the pair today are expected to be determined by unemployment rate and inflation data from Germany. Additionally, investors would keep a close eye on GDP numbers from the US.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.