For the 24 hours to 23:00 GMT, the EUR rose 0.24% against the USD and closed at 1.0581 on Friday.

In economic news, data indicated that French consumer confidence remained steady at a level of 98.0 in November, meeting market expectations and following a similar reading in the previous month.

On the economic front, data revealed that the US flash Markit services PMI unexpectedly eased to a level of 54.7 in November, but remained in the expansion territory, while markets expected it to remain steady at a level of 54.8, recorded in the prior month. Additionally, the nation’s goods trade deficit widened more-than-expected to a level of $62.0 billion in October, following a deficit of $56.0 billion in the preceding month, whereas investors anticipated the nation to post a goods trade deficit of $59.2 billion. Moreover, the nation’s flash wholesale inventories surprisingly dropped by 0.4% MoM in October, defying market expectations for an advance of 0.2% and after recording a rise of 0.1% in the previous month.

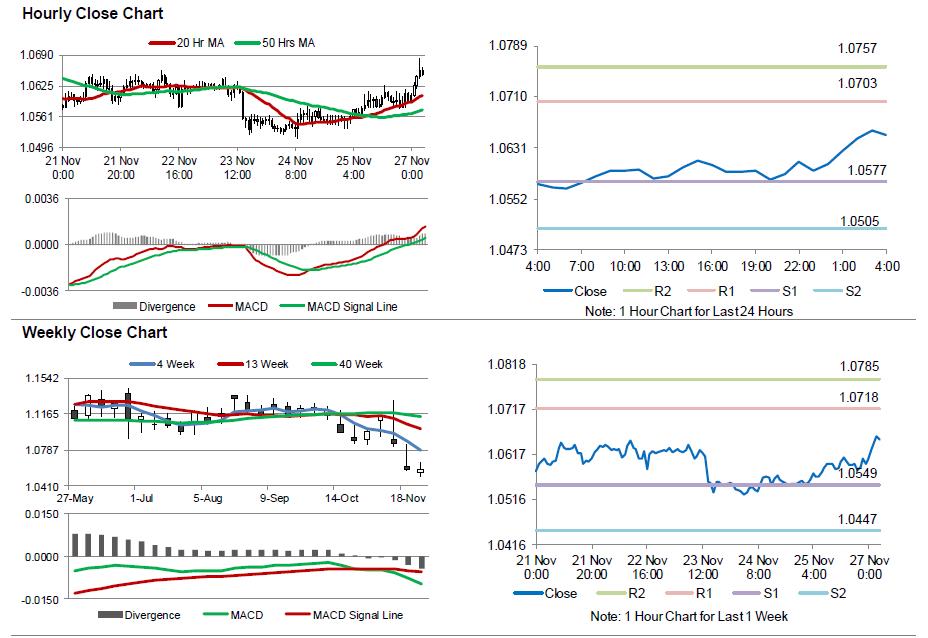

In the Asian session, at GMT0400, the pair is trading at 1.0650, with the EUR trading 0.65% higher against the USD from Friday’s close.

The pair is expected to find support at 1.0577, and a fall through could take it to the next support level of 1.0505. The pair is expected to find its first resistance at 1.0703, and a rise through could take it to the next resistance level of 1.0757.

Going ahead, investors will keep a close watch on a speech by the ECB President Mario Draghi, scheduled later in the day along with OECD’s economic outlook report, due in a few hours. Additionally, the US Dallas Fed manufacturing activity index for November, slated to release later today, will be on investor’s radar.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.