For the 24 hours to 23:00 GMT, the EUR declined 0.37% against the USD and closed at 1.1789, following downbeat economic releases in the Euro-zone as well as Germany.

The Euro came under pressure after German factory orders retreated more than expected 2.4% on a MoM basis in November, compared to a revised advance of 2.9% recorded in the preceding month. Markets were expecting it to drop 0.8%. Also economic confidence in the common-currency region unexpectedly remained unchanged at 100.7 in December, against market expectations for a rise to a level of 101.2.

On the other hand, the Euro-zone’s retail sales surprisingly rose 1.5% on an annual basis in November, higher than market expected rise of 0.2%. It had risen 1.6% in October.

In the US, number of people claiming unemployment benefits for the first time unexpectedly advanced to 294 K in the week ended January 3, against market expectations to drop to a level of 290 K and following a reading of 298 K registered in the prior week. Also, the nation’s consumer credit advanced less than anticipated to $14.08 billion in November, compared to a revised advance of $15.97 billion in the prior month. Market expectations were for consumer credit to climb $15.00 billion. Meanwhile, the number of planned layoffs by the US companies climbed 6.60% in December on a YoY basis. In the previous month, the number of layoffs had fallen 20.70%.

In the Asian session, at GMT0400, the pair is trading at 1.1804, with the EUR trading 0.13% higher from yesterday’s close.

Earlier today, the Minneapolis Fed President, Narayana Kocherlakota, urged the US central bank to not raise interest rates in 2015, stating that such a step would slow the nation’s economic recovery and the Fed’s progress towards achieving its 2% inflation target.

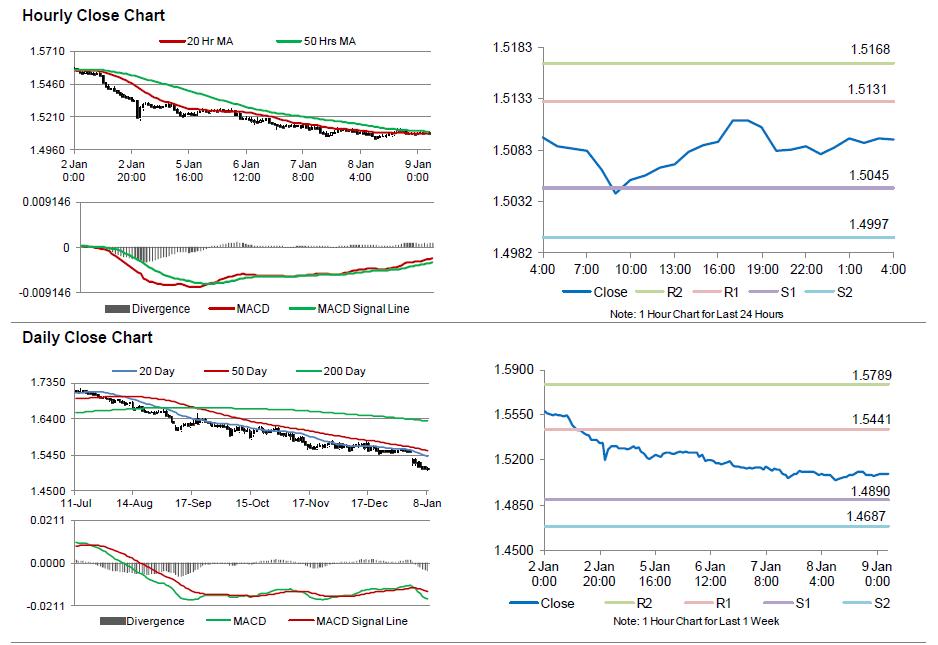

The pair is expected to find support at 1.1762, and a fall through could take it to the next support level of 1.1719. The pair is expected to find its first resistance at 1.1839, and a rise through could take it to the next resistance level of 1.1875.

Trading trends in the Euro today are expected to be determined by Germany’s industrial production as well as trade balance data, scheduled in few hours. Additionally, market participants would also concentrate on the US non-farm payrolls as well as unemployment rate data, scheduled later today.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.