For the 24 hours to 23:00 GMT, the EUR declined 0.12% against the USD and closed at 1.3613, as the greenback advanced after data showed that initial claims for unemployment benefits in the US fell by 2,000 to a seasonally adjusted 312,000 in the previous week and as consumer speeding in the world’s largest economy posted a modest month-on-month rise of 0.2% in the month of May. However, the US initial jobless claims and consumer spending failed to market expectations. Adding to the positive sentiment for the US Dollar were comments from the St. Louis Fed President, James Bullard, who expressed optimism on the growth of the US labour markets and opined that an interest rate hike in the US economy by the end of the first quarter of 2015 would be appropriate. Separately, Richmond Fed President, Jeffrey Lacker, hinted that the central bank would start raising its interest rates “even if growth remains relatively subdued as it has been over the past five years.”

In other US economic news, personal income in the nation increased 0.4% (MoM) in May, in line with economist estimates, while the Kansas City Fed’s manufacturing composite index slipped to a reading of 6.0 in June, the lowest reading since February 2014.

Meanwhile, in the Euro-zone, data from French Insee showed that consumer confidence in the Euro-zone’s second largest economy unexpectedly rose to a reading of 86.0 in June from previous month’s level of 85.0.

In the Asian session, at GMT0300, the pair is trading at 1.3624, with the EUR trading 0.08% higher from yesterday’s close.

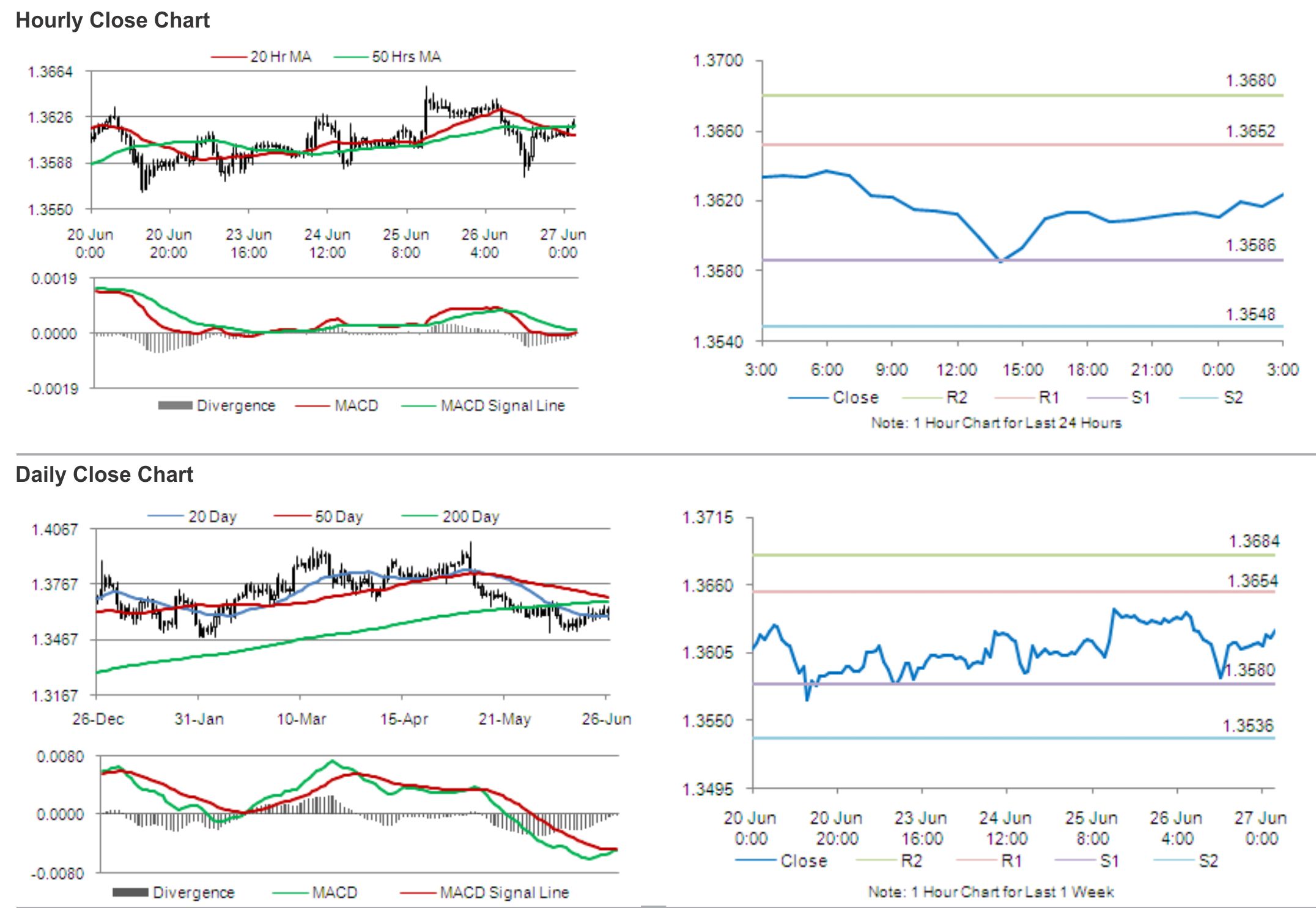

The pair is expected to find support at 1.3586, and a fall through could take it to the next support level of 1.3548. The pair is expected to find its first resistance at 1.3652, and a rise through could take it to the next resistance level of 1.3680.

During the later course of the day, traders would eye Euro-zone’s business and consumer confidence data, along with German consumer inflation and French GDP data, slated for release later today.

The currency pair is trading just above its 20 Hr moving average and is showing convergence with its 50 Hr moving average.