For the 24 hours to 23:00 GMT, the EUR rose 0.65% against the USD and closed at 1.1057.

Macroeconomic data indicated that Germany’s Gfk consumer confidence index fell to a level of 10.0 in August, as economic and income expectations deteriorated after Brexit. The index had recorded a reading of 10.1 in the previous month while markets expected it to fall to a level of 9.9.

Yesterday, the US Federal Reserve, in its latest monetary policy meeting, left its key interest rate unchanged at 0.5%, in line with market expectations. In its post-meeting statement, the central bank highlighted that near-term risks to the US economic outlook has diminished and gains in the labour market were strong in June, suggesting that conditions are getting more favourable for a rate hike in September. Further, the bank also reiterated that it continues to closely monitor global economic and financial developments.

In other economic news, the US flash durable goods orders slid more-than-anticipated by 4.0% MoM basis in June, thus pointing towards weak business spending, compared to a drop of 2.3% in the previous month whereas markets anticipated it to ease by 1.4%. Further, the nation’s pending home sales advanced 0.2% on a monthly basis in June, lower than market expectations for an advance of 1.2% and following a drop of 3.7% in the prior month. Also, mortgage applications declined by 11.2% in the week ended 22 July, compared to a fall of 1.3% in the previous week.

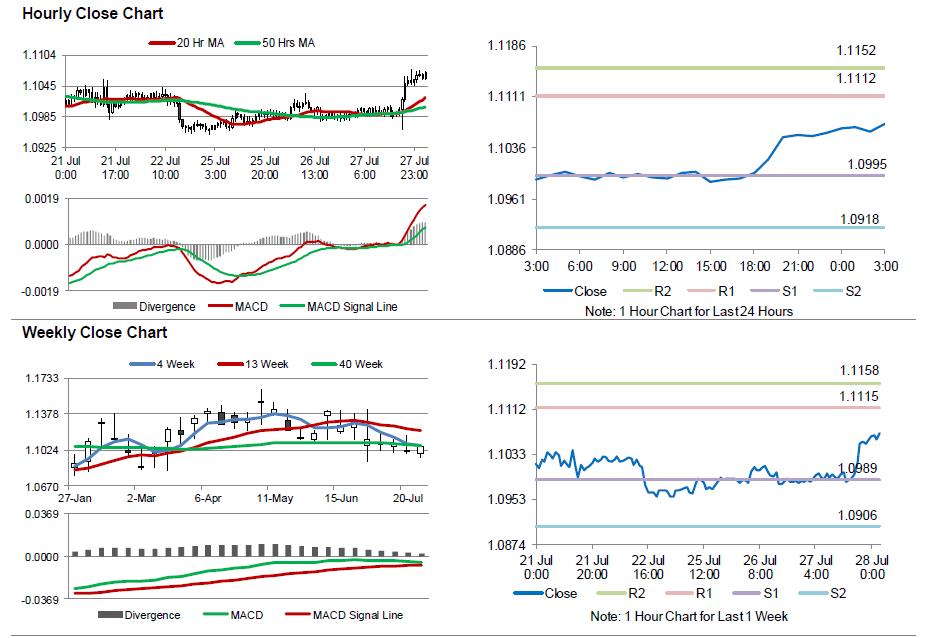

In the Asian session, at GMT0300, the pair is trading at 1.1071, with the EUR trading 0.13% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.0995, and a fall through could take it to the next support level of 1.0918. The pair is expected to find its first resistance at 1.1112, and a rise through could take it to the next resistance level of 1.1152.

Going ahead, investors will look forward to Germany’s unemployment rate and consumer price index data, due in a few hours. Additionally, in the US, the initial jobless claims, slated to release later today, will also garner a lot of market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.