For the 24 hours to 23:00 GMT, the EUR declined 0.40% against the USD and closed at 1.0833, after Germany’s industrial production advanced less-than-expected in October.

Data showed that German industrial production rebounded after two months of declines by 0.2% MoM in October but increased less than market expectations for a rise of 0.8%. It had dropped 1.1% in the previous month.

In other economic news, Euro-zone’s Sentix investor confidence index rose for a second straight month to a level of 15.7 in December, its highest level in four months, after recording a reading of 15.1 in the previous month. Investors had expected the index to climb to a level of 17.0.

In the US, the labour market conditions index fell to a level of 0.5 in November, after recording a reading of 2.2 in the previous month and against investor expectations for it to reach a level of 1.6. Also, the nation’s consumer credit rose less-than-expected by $16.0 billion in October, compared to market expectations for a rise of $19.0 billion. In the prior month, consumer credit had risen by a revised $28.6 billion.

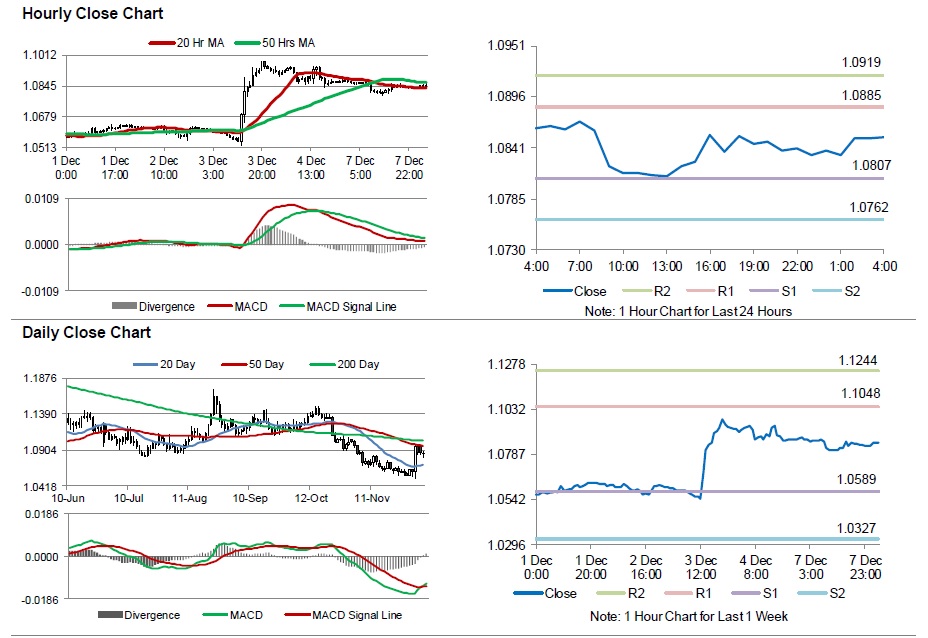

In the Asian session, at GMT0400, the pair is trading at 1.0852, with the EUR trading 0.17% higher from yesterday’s close.

The pair is expected to find support at 1.0807, and a fall through could take it to the next support level of 1.0762. The pair is expected to find its first resistance at 1.0885, and a rise through could take it to the next resistance level of 1.0919.

Going ahead, investors will look forward to Euro-zone’s preliminary Q3 GDP data, scheduled to be released in a few hours.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.