For the 24 hours to 23:00 GMT, the EUR declined marginally against the USD and closed at 1.1019.

Yesterday, the ECB Governing Council member, Jens Weidmann, warned that adding excessive stimulus and keeping interest rates too low for long has risks and its effects would be dangerous to ignore.

In other economic news, the French consumer confidence index declined unexpectedly to a 6-month low level of 95.0 in February, while investors had expected it to remain steady at 97.0.

In the US, the flash Markit services PMI unexpectedly contracted for the first time since October 2013, after it fell to a level of 49.8 in February, raising concerns about the nation’s economic outlook. Investors expected it to rise to a level of 53.5 and following a reading of 53.2 in the preceding month. Additionally, the nation’s new home sales declined more-than-anticipated by 9.2% MoM in January, after recording a revised gain of 8.2% in the previous month and compared to investor expectations for a fall of 4.4%. Also, the nation’s MBA mortgage applications dropped 4.3% in the week ended 19 February, following a gain of 8.2% in the prior week.

Separately, the Richmond Fed President, Jeffrey Lacker, hinted that the central bank has much scope for further interest rate hike, amid strength in the US job market. On the contrary, St. Louis Fed President, James Bullard, reiterated that the central bank should not hike interest rate further given that the US inflation expectations have fallen. Meanwhile, the Dallas Fed President, Robert Kaplan, expressed that there is a low possibility of recession in the US this year.

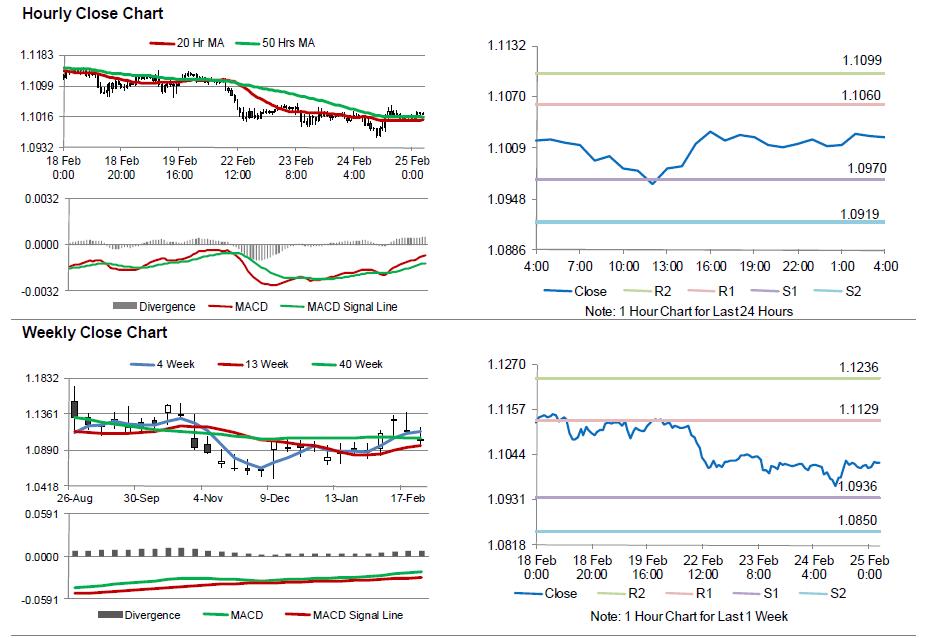

In the Asian session, at GMT0400, the pair is trading at 1.1022, with the EUR trading marginally higher from yesterday’s close.

The pair is expected to find support at 1.0970, and a fall through could take it to the next support level of 1.0919. The pair is expected to find its first resistance at 1.1060, and a rise through could take it to the next resistance level of 1.1099.

Going ahead, investors would closely monitor the Euro-zone’s consumer price index and Germany’s Gfk consumer confidence index data, slated to be released in a few hours. Additionally, the US initial jobless claims and durable goods orders data, due for release later in the day, will also keep investors on their toes.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.