For the 24 hours to 23:00 GMT, the EUR rose 0.19% against the USD and closed at 1.1211, after the ECB President, Mario Draghi, stated that the Euro-zone is on its path to recovery, thus signalling the success of the central bank’s accommodative monetary policy.

Macroeconomic data on Friday showed that Euro-zone’s producer prices fell more-than-expected to 0.8% MoM in August, from a revised 0.2% drop in July.

In the US, a lacklustre jobs data raised concerns over the strength of the economy and pushed back expectations of a rate hike this year. As per the non-farm payrolls report, the US economy added 142,000 jobs in September, below market expectations for 201,000 jobs. Unemployment rate for the month stayed at 5.1%. Further, average hourly earnings showed no change on a monthly basis, missing investor expectations for 0.2% growth.

In other economic news, the US factory orders dipped 1.7% in August, reporting its worst fall in eight months.

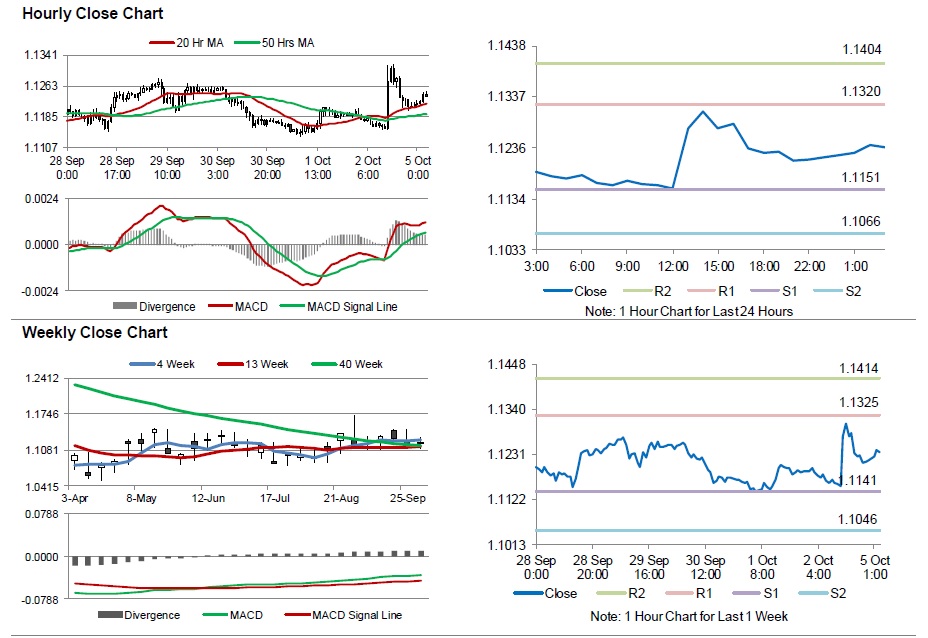

In the Asian session, at GMT0300, the pair is trading at 1.1236, with the EUR trading 0.23% higher from Friday’s close.

On Saturday, the Federal Reserve Vice Chairman, Stanley Fischer, stated that although the central bank’s policy tool kit is not adept enough to deal with financial bubbles and as such he does not see an immediate risk of such bubbles in the US.

The pair is expected to find support at 1.1151, and a fall through could take it to the next support level of 1.1066. The pair is expected to find its first resistance at 1.1320, and a rise through could take it to the next resistance level of 1.1404.

Going ahead, market participants will look forward to the release of Euro-zone’s retail sales and the investor confidence index data, scheduled today. In addition, today’s services PMI data of the Eurozone and its peripheries would grab a lot of investor attention. Investors would also focus on ISM non-manufacturing PMI as well as Markit services PMI of the US, due later in the day.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.