For the 24 hours to 23:00 GMT, the EUR rose 0.26% against the USD and closed at 1.2506.

In economic news, Germany’s import price index slid 0.3% on a monthly basis in October, following a rise of 0.3% recorded in September, while markets were expecting the index to ease 0.5%.

Elsewhere, in France, the consumer confidence index climbed to a level of 87.0 in November, compared to market expectations of a rise to 86.0. In the previous month, consumer confidence had registered a reading of 85.0. Meanwhile, consumer confidence in Italy unexpectedly declined to 100.2 in November, lower than market expectations of a rise to a level of 101.6.

Yesterday, the ECB, Vice President, Vitor Constancio, stated that the central bank would be able to gauge in the first quarter of 2015 whether it requires to commence purchases of sovereign bonds.

The greenback traded on a weaker footing following soft jobless claims and housing data in the US. The number of people claiming initial unemployment benefits surprisingly climbed to 313.0 K in the week ended November 22, marking its highest level since September and compared to a revised level of 292.0 K registered in the previous week, while markets were expecting it to drop to 288.0 K. The US pending home sales unexpectedly declined 1.1% on a monthly basis in October, following a revised advance of 0.6% recorded in September. Market expectations were for it to advance 0.5%. Also, the Chicago Fed PMI fell to 60.8 in November, down from previous month’s level of 66.2 and compared to market expectations to drop to a level of 63.0. Additionally, the nation’s new home sales rose 0.7% on a monthly basis in October, lower than market expected increase of 0.8%.

The nation’s durable goods orders unexpectedly rebounded 0.4% in October, beating market expectations for a drop of 0.6% and compared to a revised drop of 0.9% registered in the previous month. Meanwhile, core personal consumption expenditure rose 0.2% on a monthly basis in October, at par with market expectations, while personal income remained unchanged at 0.2% in October. Additionally, the Michigan consumer sentiment index surprisingly narrowed to 88.8 in November, lower than market anticipations to climb to a level of 90.0. The index had reached a mark of 89.4 in the prior month.

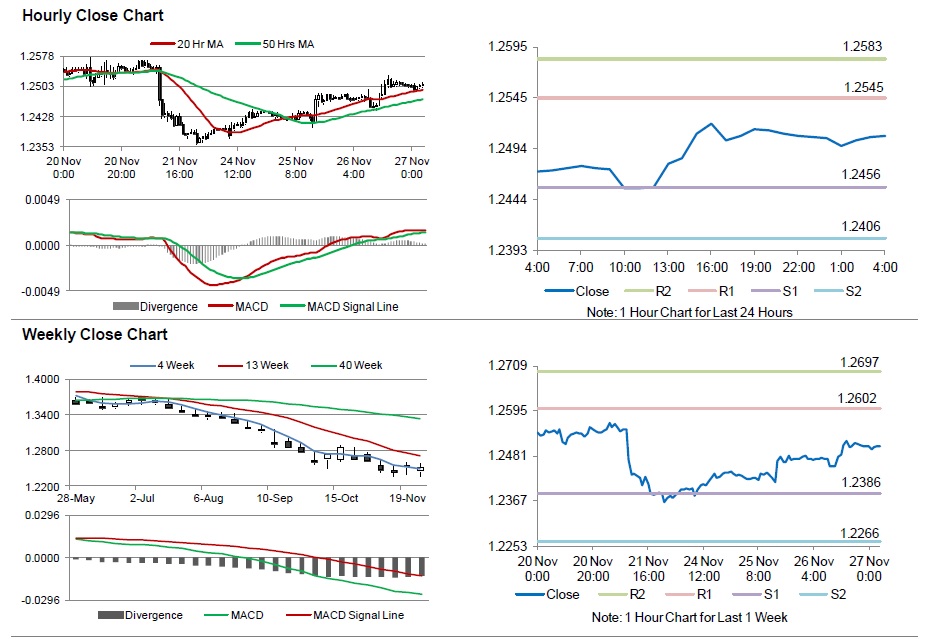

In the Asian session, at GMT0400, the pair is trading at 1.2507, with the EUR trading marginally higher from yesterday’s close.

The pair is expected to find support at 1.2456, and a fall through could take it to the next support level of 1.2406. The pair is expected to find its first resistance at 1.2545, and a rise through could take it to the next resistance level of 1.2583.

Trading trends in the Euro today are expected to be determined by Germany’s crucial inflation data, scheduled later today. Meanwhile, investor sentiment would also be governed by Germany’s unemployment data, set for release in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.