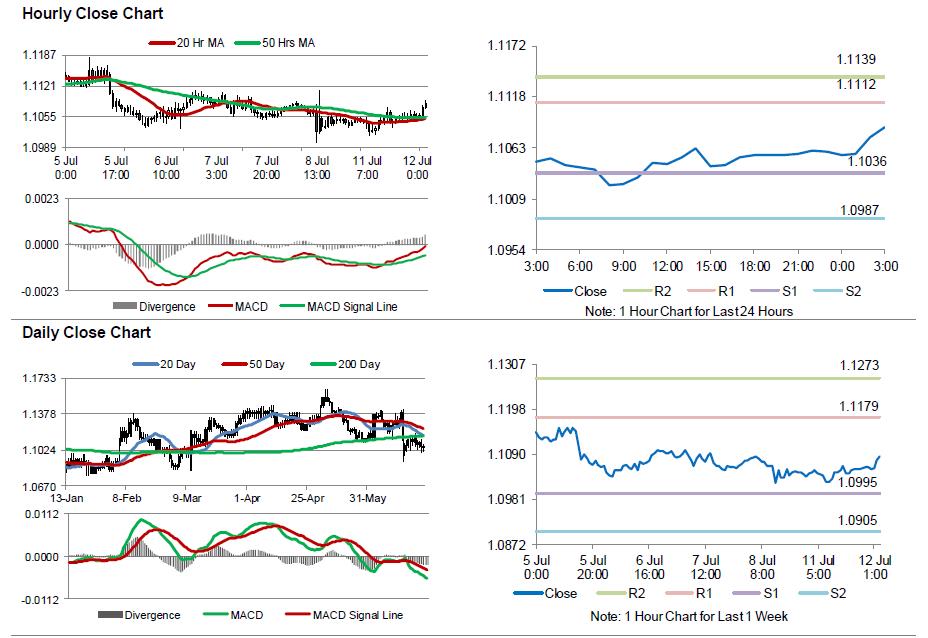

For the 24 hours to 23:00 GMT, the EUR rose 0.1% against the USD and closed at 1.1059.

Macroeconomic data indicated that, the US labour market conditions index fell to a level of -1.9 in June, falling for sixth straight month, following a revised level of -3.6 in the previous month and compared to market expectations for a fall to a level of -1.2.

In the Asian session, at GMT0300, the pair is trading at 1.1085, with the EUR trading 0.24% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1036, and a fall through could take it to the next support level of 1.0987. The pair is expected to find its first resistance at 1.1112, and a rise through could take it to the next resistance level of 1.1139.

Going ahead, market participants await the release of Germany’s final consumer price index data for June, scheduled to be released in a few hours. Additionally, the US NFIB small business optimism index and JOLTS job openings data, slated to release later in the day, will grab market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.