For the 24 hours to 23:00 GMT, the EUR declined 1.49% against the USD and closed at 1.1195.

In economic news, Germany’s seasonally adjusted unemployment rate remained unchanged at 6.5% in February, at par with market expectations. Meanwhile, number of people unemployed in the nation recorded a drop of 20.00 K in February, more than market expectations for a fall of 10.00 K. In the prior month, number of jobless people had fallen by a revised 10.00 K.

On the other hand, Germany’s GfK consumer confidence index rose to a level of 9.7, notching its highest level since October 2001 in March, higher than market expectations for an advance to 9.5.

In the US, the CPI fell more than expected by 0.7% on a monthly basis in January, marking its biggest decline in six years, after slipping by a revised 0.3% in the preceding month, thus mounting pressure on the Fed to maintain its interest rate low a bit longer. Meanwhile, number of people claiming jobless benefits for the first time climbed more than expected to 313 K in the week ended 21 February, against market expectations of 290 K and compared to prior month’s revised level of 282 K.

Other economic data showed that durable goods orders rebounded 2.8%, registering its first rise in 3-months in January and following a 3.7% fall recorded in the prior month, while markets were expecting a 1.6% gain.

In the Asian session, at GMT0400, the pair is trading at 1.1211, with the EUR trading 0.14% higher from yesterday’s close.

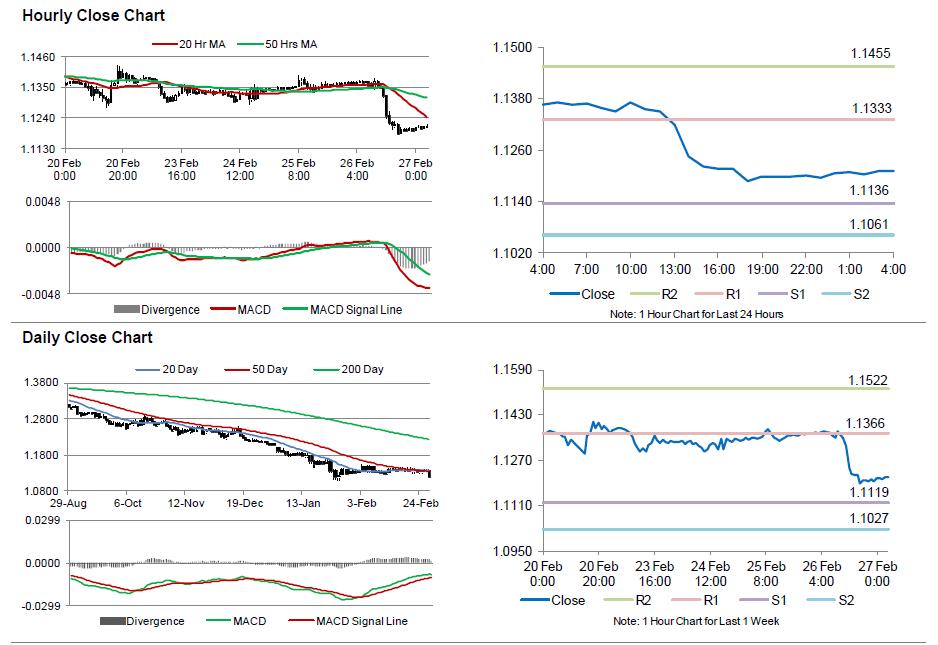

The pair is expected to find support at 1.1136, and a fall through could take it to the next support level of 1.1061. The pair is expected to find its first resistance at 1.1333, and a rise through could take it to the next resistance level of 1.1455.

Trading trends in the pair today are expected to be determined by Germany’s CPI data, scheduled in a few hours. Additionally, the US 4Q GDP data, scheduled later today, would be closely monitored by the market participants.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.