For the 24 hours to 23:00 GMT, the EUR declined 0.26% against the USD and closed at 117.27.

Losses were kept in check, following better than expected services PMI data from the Euro-zone and Germany.

In the Euro-zone, the final services PMI rose more than expected to 52.6 in January, compared to market expectations of an unchanged reading of 52.3 recorded in the previous month. Additionally, Germany’s services PMI surprisingly advanced to 54.0 in January, higher than market expectations for a rise to a level of 52.7, thus indicating that the European economy was gaining momentum in early 2015.

Elsewhere, in Italy, services sector came out of contraction and entered expansion territory in January, while services activity in France further dipped into contraction territory in the same month.

In other economic news, retail sales in the Euro-zone increased 2.8% on a YoY basis, posting a 8-year high in December, higher than previous month’s advance of 1.5% and compared to market expected advance of 2.0%.

The greenback traded on a stronger footing, after the US ISM non-manufacturing PMI stood at 56.7 in January, from previous month’s reading of 56.5. Also, the final Markit services PMI recorded a rise to 54.2 in January, higher than market expectations of a rise to a level of 54.1. On the other hand, the ADP private sector employment climbed less than anticipated by 213.0 K in January, following a revised gain of 253.0 K in the prior month. Markets were expecting the private sector employment to rise 220.0 K. Meanwhile, mortgage applications in the US advanced 1.3% in the week ended 30 January 2015, compared to a drop of 3.2% registered in the prior week.

Separately, the Cleveland Fed President, Loretta Mester opined that there was a need to hike interest rates in near term, amid escalating economic recovery in the US. Furthermore, she indicated that gradual recovery in the labour markets and low oil prices could provide a boost to consumer spending in the nation.

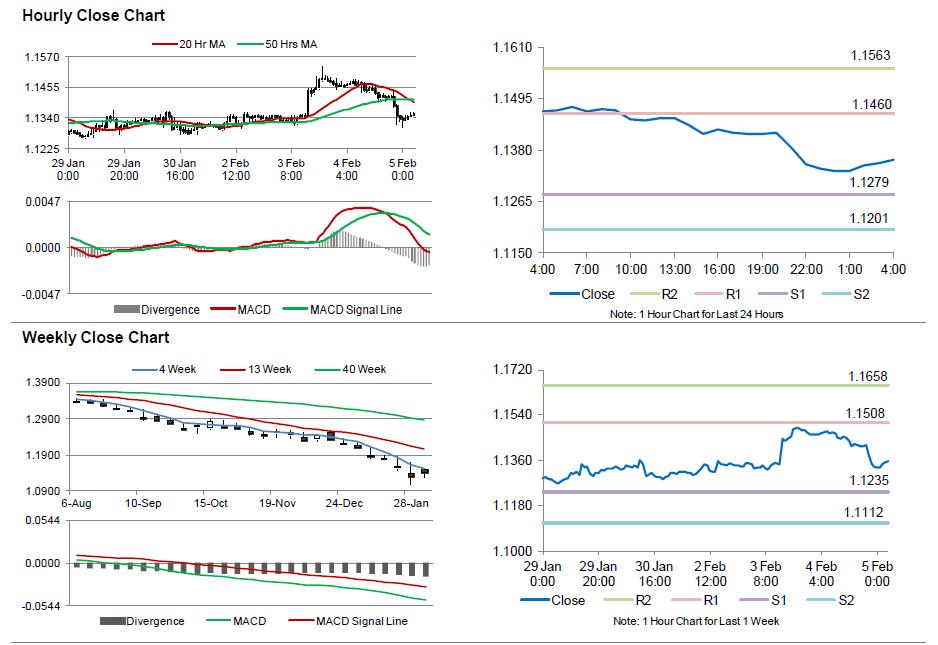

In the Asian session, at GMT0400, the pair is trading at 1.1358, with the EUR trading 0.18% higher from yesterday’s close.

The pair is expected to find support at 1.1279, and a fall through could take it to the next support level of 1.1201. The pair is expected to find its first resistance at 1.146, and a rise through could take it to the next resistance level of 1.1563.

Trading trends in the Euro today are expected to be determined by Germany’s factory orders and construction PMI data, scheduled in few hours. Additionally, initial jobless claims data from the US scheduled later today, would grab lot of market attention

The currency pair is trading below its 20 Hr and 50 Hr moving averages.