For the 24 hours to 23:00 GMT, the EUR rose 0.58% against the USD and closed at 1.0665.

In economic news, Germany’s wholesale price index remained flat on a monthly basis in March, following a revised rise of 0.5% in the prior month.

The greenback tumbled against a basket of currencies, after the US President, Donald Trump, stated that the local currency was getting ‘too strong’.

On the macro front, the US budget deficit widened more-than-anticipated to a level of $176.2 billion in March, compared to market expectations for the nation to post a deficit of $169.0 billion and following a deficit of $108.0 billion in the preceding month. On the contrary, the nation’s mortgage applications rebounded 1.5% in the week ended 07 April, compared to a fall of 1.6% in the previous month.

In other economic news, the nation’s import price index recorded a drop of 0.2% YoY in March, meeting market expectations and following a revised gain of 0.4% in the prior month. Further, the nation’s export price index surprisingly climbed 0.2% on a monthly basis in March. The index had climbed by 0.3% in the previous month, while markets anticipated for a flat reading.

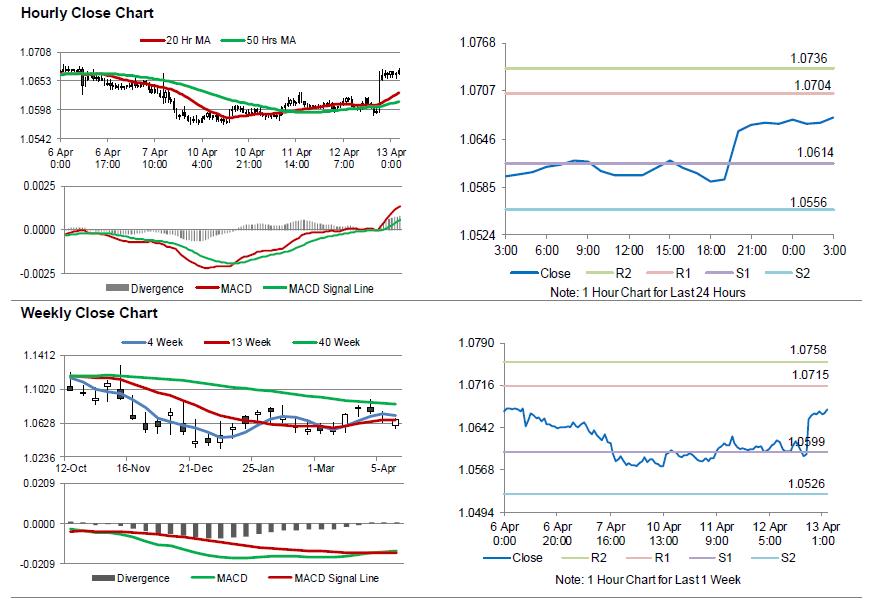

In the Asian session, at GMT0300, the pair is trading at 1.0673, with the EUR trading 0.08% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.0614, and a fall through could take it to the next support level of 1.0556. The pair is expected to find its first resistance at 1.0704, and a rise through could take it to the next resistance level of 1.0736.

Going ahead, investors will focus on Germany’s final consumer price index for March, slated to release in a few hours. Additionally, in the US, the flash Reuters/Michigan consumer confidence index for April, coupled with weekly jobless claims data, will be on investor’s radar.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.