For the 24 hours to 23:00 GMT, the EUR declined 0.29% against the USD and closed at 1.0886.

In economic news, data indicated that Italy’s seasonally adjusted industrial production dropped less-than-expected by 0.8% MoM in September, declining for the first time in three months, compared to a revised advance of 1.8% in the prior month while markets anticipated it to ease by 1.0%.

The US Dollar gained ground, after the number of Americans filing for fresh unemployment benefits dropped more-than-anticipated to a level of 254.0K in the week ended 05 November, pointing towards healthy momentum in the nation’s labour market. Markets expected initial jobless claims to drop to a level of 260.0K, following a level of 265.0K in the previous week. Moreover, the nation posted a less-than-estimated budget deficit of $44.2 billion in October, compared to a revised deficit of $136.6 billion in the previous month.

Meanwhile, the St. Louis Fed President, James Bullard, stated that he remains on board with raising interest rate next month and reiterated his call for monetary policy to remain accommodative with just a single 0.25% rate hike over the next two to three years.

In the Asian session, at GMT0400, the pair is trading at 1.0901, with the EUR trading 0.14% higher against the USD from yesterday’s close.

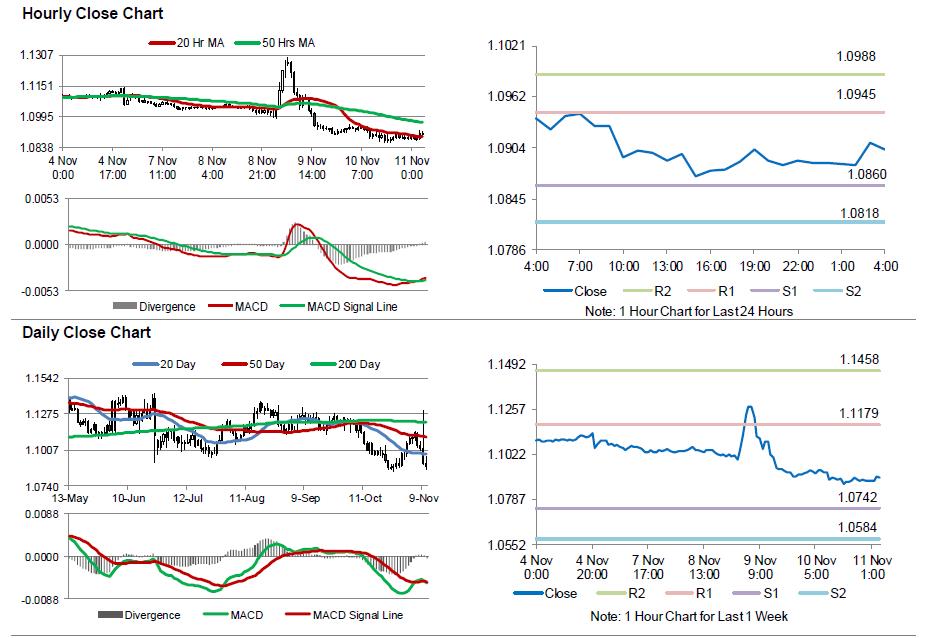

The pair is expected to find support at 1.0860, and a fall through could take it to the next support level of 1.0818. The pair is expected to find its first resistance at 1.0945, and a rise through could take it to the next resistance level of 1.0988.

Looking ahead, investors would turn their attention to Germany’s consumer price index for October, due to release in a few hours. Further, the US preliminary Michigan consumer sentiment index for November, slated to release later in the day, would also pique investor attention.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.