For the 24 hours to 23:00 GMT, the EUR declined 0.48% against the USD and closed at 1.1094.

In economic news, Germany’s producer price index rose 0.10% MoM in April, compared to a similar rise in the previous month. Markets were anticipating the index to advance 0.20%. Meanwhile, the seasonally adjusted construction output in the Euro-zone recorded a rise of 0.80% in March on a monthly basis. Construction output had fallen by a revised 1.60% in the previous month.

In the US, the FOMC minutes revealed that the policy makers remained doubtful to begin raising interest rates in June. The Fed members stated that they would not start raising interest rates until they see further improvement in the labour market and feel confident that inflation would rise towards their target of 2.0%.

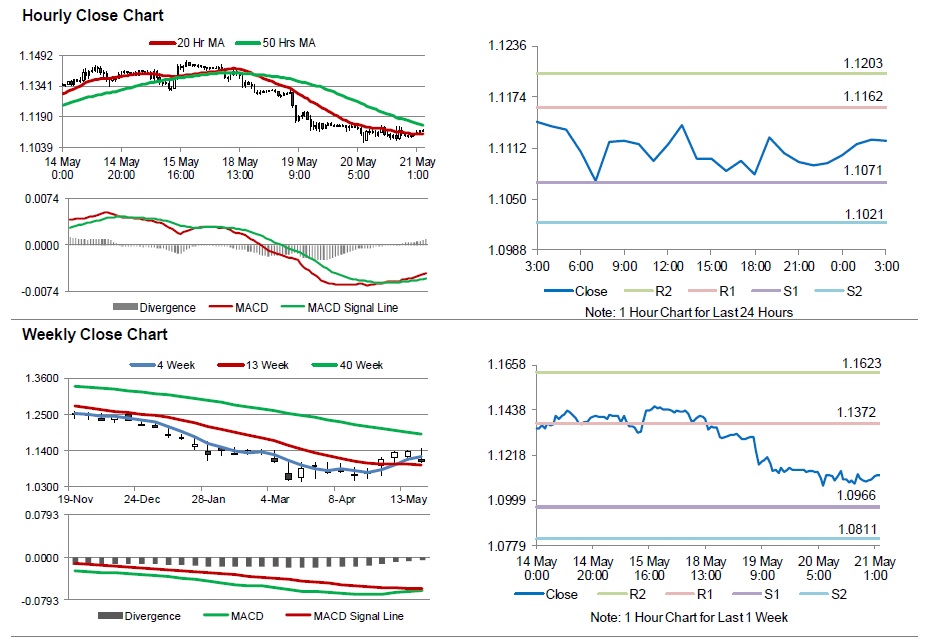

In the Asian session, at GMT0300, the pair is trading at 1.1121, with the EUR trading 0.25% higher from yesterday’s close.

The pair is expected to find support at 1.1071, and a fall through could take it to the next support level of 1.1021. The pair is expected to find its first resistance at 1.1162, and a rise through could take it to the next resistance level of 1.1203.

Trading trends in the pair today are expected to be determined by the manufacturing and services PMI data from the Euro-zone and its peripheries, scheduled in a few hours.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.