For the 24 hours to 23:00 GMT, the EUR rose 0.61% against the USD and closed at 1.1217.

Yesterday, the EU Economic and Financial Affairs Council stated that economic outlook of Europe was improving, however none of the member states of the EU could afford to slow down on implementation of reforms. Further, the council added that EU must first address its structural weaknesses in order to enhance the growth potential of Europe.

In the US, data showed that budget surplus recorded a level of $156.71 billion in April, from a budget deficit of $52.91 billion in the previous month. Markets were anticipating the nation’s surplus to come in at $151.50 billion. Meanwhile, JOLTs job openings fell to a level of 4994.00 K in March while markets expected it ease to 5140.00 K, after registering a revised reading of 5144.00 K in the prior month

In the speeches, the San Francisco Fed President, John Williams opined that the Fed should raise its benchmark interest rates before inflation reaches the Fed’s target of 2.0%, based on the economy’s solid footing.

Separately, the New York Fed President, William Dudley stated that he was not sure when the Fed would raise its interest rates.

In the Asian session, at GMT0300, the pair is trading at 1.1240, with the EUR trading 0.2% higher from yesterday’s close.

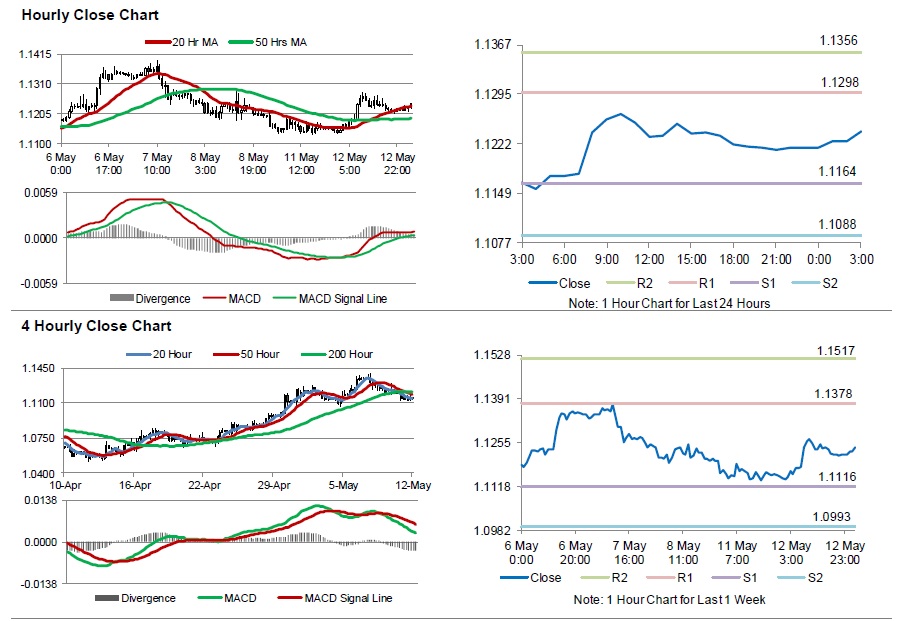

The pair is expected to find support at 1.1164, and a fall through could take it to the next support level of 1.1088. The pair is expected to find its first resistance at 1.1298, and a rise through could take it to the next resistance level of 1.1356.

Trading trends in the Euro today are expected to be determined by the preliminary estimate of Germany’s seasonally adjusted Q1 GDP, along with the nation’s CPI data scheduled in a few hours. Additionally, the US retail sales data, scheduled later today would generate lot of market attention.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.