For the 24 hours to 23:00 GMT, the EUR rose 0.21% against the USD and closed at 1.1263, after the European Central Bank (ECB) left interest rate unchanged and stopped short of a formal commitment to further expand its asset-purchase program. The main refinancing operations rate was held at 0.00% with the deposit rate at -0.40% and marginal lending facility at 0.25%. All three rates were last cut at the March meeting. There was also no announcement over an extension to the bond buying programme beyond March 2017. Further, the ECB President, Mario Draghi, indicated that interest rates are likely to remain at present levels or lower for an extended period and well past the horizon for its asset purchases.

In the US, initial jobless claims unexpectedly dropped to a level of 259.0 K in the week ended 03 September 2016, from a reading of 263.0 K in the previous week.

In the Asian session, at GMT0300, the pair is trading at 1.1278, with the EUR trading 0.13% higher against the USD from yesterday’s close.

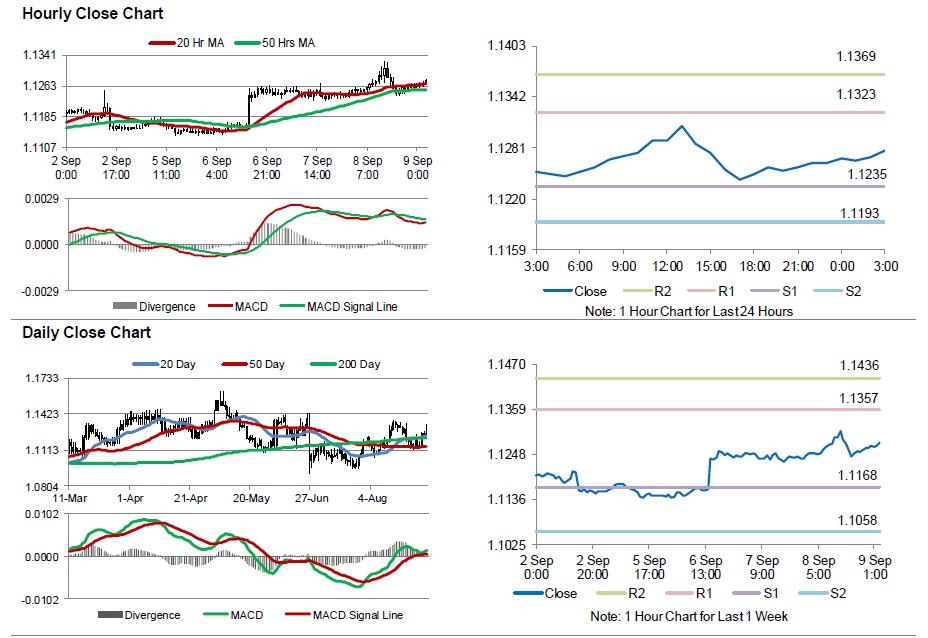

The pair is expected to find support at 1.1235, and a fall through could take it to the next support level of 1.1193. The pair is expected to find its first resistance at 1.1323, and a rise through could take it to the next resistance level of 1.1369.

Going ahead, market participants look forward to Germany’s trade balance data which is expected to show a wider surplus for July, scheduled to release in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.