For the 24 hours to 23:00 GMT, the EUR declined 1.38% against the USD and closed at 1.0733, after Germany’s industrial output posted its steepest drop on a monthly basis in September.

Data showed that, Germany’s industrial production fell unexpectedly by 1.1% MoM in September, from a revised fall of 0.6% in the previous month. Investors had expected it to rise 0.5%.

Separately, the ECB’s Executive Board member, Peter Praet, stated that the central bank intends to continue its quantitative easing programme until it attains the bank’s set inflation target.

The greenback gained ground, following the release of stronger than expected employment data in October. Data indicated that US unemployment rate fell to 5.0% in October, its lowest level since April 2008, from 5.1% in the previous month. Additionally, the country’s nonfarm payrolls rose more-than-expected by 271.0K in October, following a downwardly revised gain of 137.0K in the previous month, thus supporting the view that the Fed will likely raise interest rates next month. Markets were anticipating it to increase by 185.0K.

Elsewhere, the Federal Reserve Governor, Lael Brainard, repeated her earlier statement that the central bank should express caution in raising interest rates given the weak global economy.

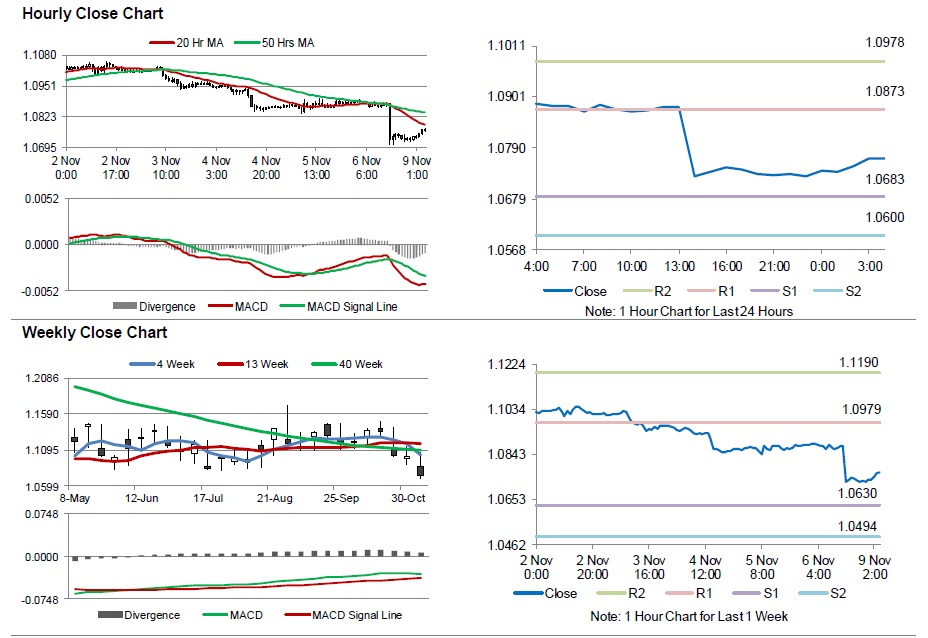

In the Asian session, at GMT0400, the pair is trading at 1.0767, with the EUR trading 0.32% higher from Friday’s close.

The pair is expected to find support at 1.0683, and a fall through could take it to the next support level of 1.0600. The pair is expected to find its first resistance at 1.0873, and a rise through could take it to the next resistance level of 1.0978.

Moving ahead, market participants will keep a close watch on Germany’s trade balance data and the Euro-zone’s Sentix investor confidence data, scheduled to be released in a few hours. Moreover, the US labour market conditions index data for October, scheduled to be released later in the day, will also garner investor attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.