On Friday, the EUR declined 1.38% against the USD and closed at 1.1318.

The USD traded on a stronger footing, after the US non-farm payrolls advanced by 257.00 K in January, compared to a revised gain of 329.00 K in the previous month. Market expectations were for it to rise 230.00 K. However, unemployment rate in the nation surprisingly climbed to 5.7% in January, compared to market expectations of a steady reading of 5.6% registered in prior month.

In other economic news, the US consumer credit widened less than expected to $14.75 billion in December, against market expectations of $15.0 billion and compared to preceding month’s level of $13.47 billion. Meanwhile, average hourly earnings rose 2.2% on a YoY basis in January, compared to prior month’s revised advance of 1.9%.

Separately, the Atlanta Fed President, Dennis Lockhart opined that the US economic growth continued to be strong enough to warrant an initial hike in interest rate later this year. However, he warned that slow growth in wages and low inflation remained constraints to his expectations of a rate hike.

Elsewhere, in Germany, industrial production remained steady at 0.1% on a MoM basis in December, while markets were expecting it to increase 0.4%. Also, trade deficit in France rose to €3.45 billion in December, compared to a revised trade deficit of €3.09 billion recorded in the previous month. Markets were anticipating the nation’s trade deficit to expand to €3.30 billion.

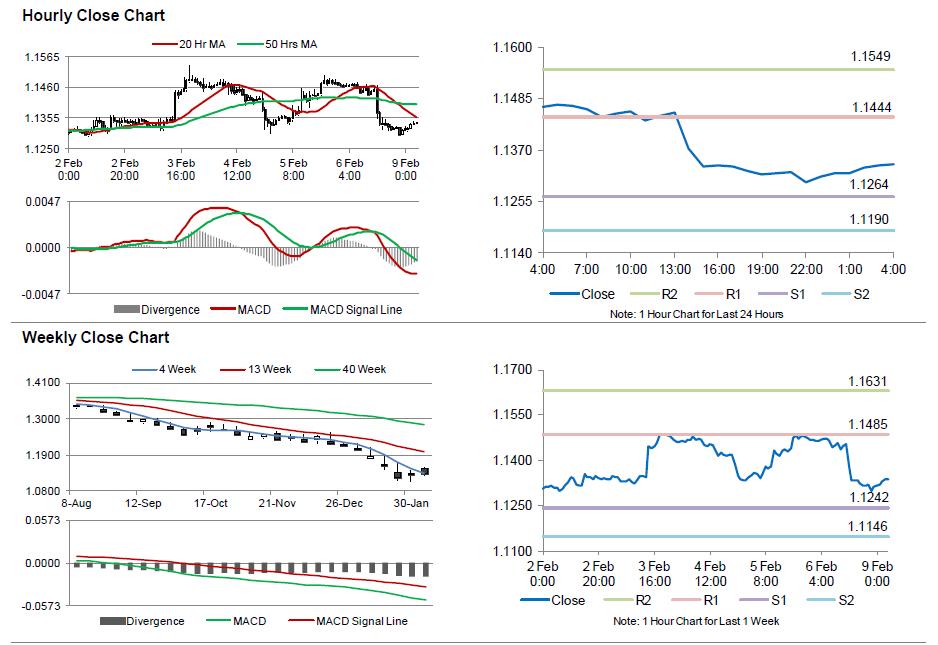

In the Asian session, at GMT0400, the pair is trading at 1.1338, with the EUR trading 0.18% higher from Friday’s close.

The pair is expected to find support at 1.1264, and a fall through could take it to the next support level of 1.1190. The pair is expected to find its first resistance at 1.1444, and a rise through could take it to the next resistance level of 1.1549.

Trading trends in the Euro today are expected to be determined by Germany’s trade balance and the Euro-zone’s Sentix investor confidence data, scheduled in few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.