For the 24 hours to 23:00 GMT, the EUR declined 0.32% against the USD and closed at 1.1307, as investors shrugged off the Euro-zone’s stronger than expected industrial production data.

Yesterday, Eurozone industrial production rose to its five-month high in July. Industrial production in the Eurozone rose 1.9% YoY and 0.6% MoM in July.

In the Asian session, at GMT0300, the pair is trading at 1.1318, with the EUR trading 0.09% higher from yesterday’s close.

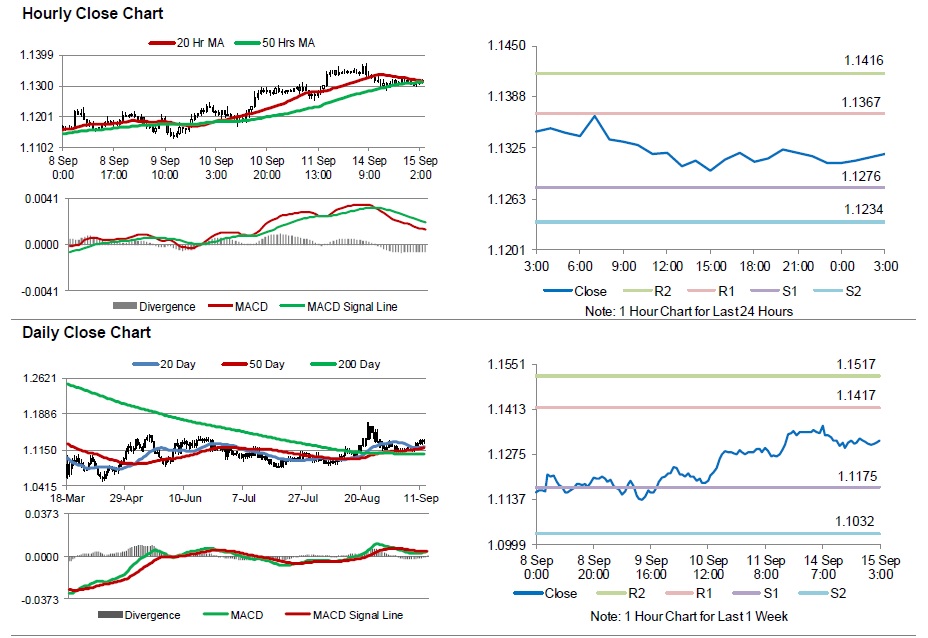

The pair is expected to find support at 1.1276, and a fall through could take it to the next support level of 1.1234. The pair is expected to find its first resistance at 1.1367, and a rise through could take it to the next resistance level of 1.1416.

Trading trends in the pair today are expected to be determined by Euro-zone’s trade balance data and ZEW survey report of Eurozone as well as Germany, scheduled in a few hours. Meanwhile, retail sales and industrial production data of US, both for August, would also grab a lot of market attention.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.