For the 24 hours to 23:00 GMT, the EUR rose marginally against the USD and closed at 1.1356.

In economic news, current account surplus in France recorded a reading of €0.20 billion in August, following a deficit of €0.40 billion in the prior month.

In the US, the President of the Atlanta Fed, Dennis Lockhart, reiterated his stand that the Fed’s decision to raise interest rates this year will be taken only after monitoring the future set of economic data. Meanwhile, the Chicago Fed President, Charles Evans, supported a gradual interest rate hike.

Separately, the Fed Governor, Lael Brainard remained dovish and cautioned that the central bank should hold off an interest rate hike, until it is clear that the global slowdown will not push the US economy off course.

In the Asian session, at GMT0300, the pair is trading at 1.1362, with the EUR trading marginally higher from yesterday’s close.

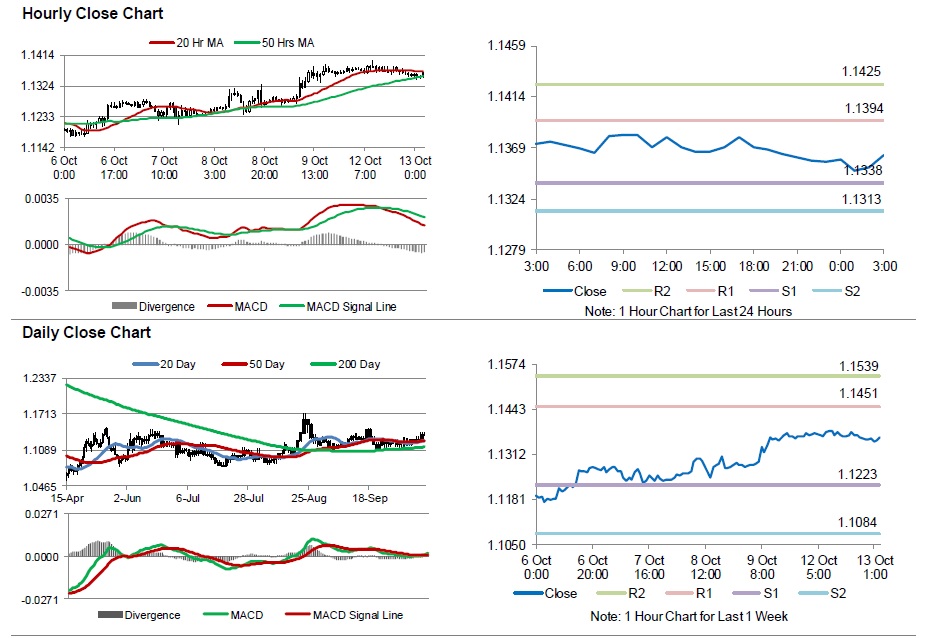

The pair is expected to find support at 1.1338, and a fall through could take it to the next support level of 1.1313. The pair is expected to find its first resistance at 1.1394, and a rise through could take it to the next resistance level of 1.1425.

Going ahead, market participants will closely monitor Germany’s inflation and ZEW current situation data, in addition to the Euro-zone’s economic sentiment data, scheduled to be released in a few hours.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.