For the 24 hours to 23:00 GMT, the EUR declined 0.56% against the USD and closed at 1.1009.

In economic news, the Euro-zone’s private sector loans edged higher by 1.6% YoY in May, following a 1.5% rise in the previous month.

In the US, preliminary reading of the Markit services PMI remained steady at a level of 51.3 in June, compared to market expectations for it to rise to a level of 52.0. Additionally, the nation’s advance goods trade deficit widened more-than-expected to a level of $60.6 billion in May, after recording a deficit of $57.5 billion in the previous month. On the other hand, the Dallas Fed manufacturing business index improved slightly to reach at a level of -18.3 in June, compared to market expectations of an advance to -15.0. In the previous month, the index had registered a reading of -20.8.

In the Asian session, at GMT0300, the pair is trading at 1.1049, with the EUR trading 0.36% higher against the USD from yesterday’s close.

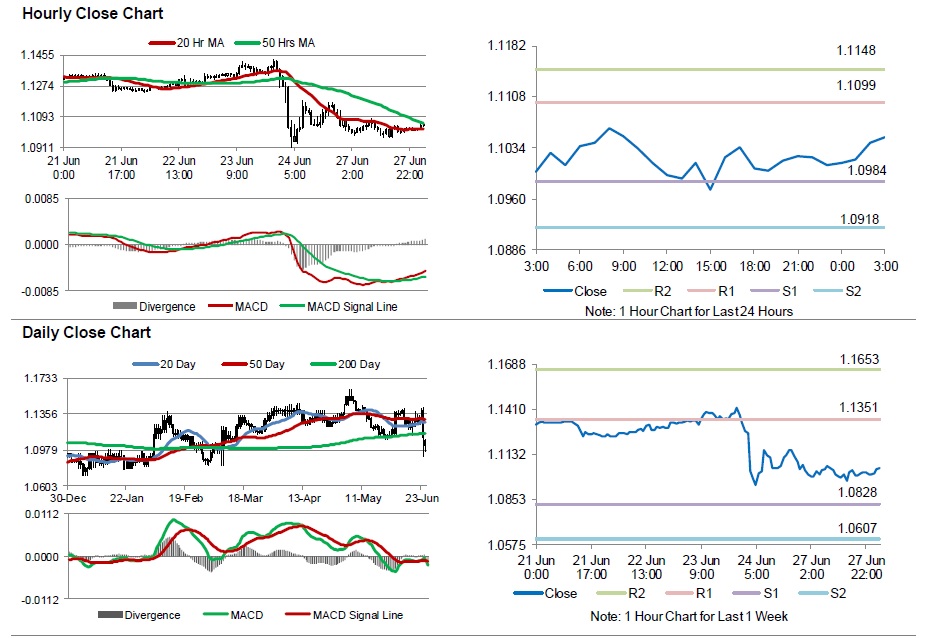

The pair is expected to find support at 1.0984, and a fall through could take it to the next support level of 1.0918. The pair is expected to find its first resistance at 1.1099, and a rise through could take it to the next resistance level of 1.1148.

Going ahead, the US final GDP for Q1, would be the key release for today. Additionally, investors would also look forward to the welcome speech by the European Central Bank (ECB) President, Mario Draghi, at the ECB’s annual forum on central banking in Sintra, Portugal today.

The currency pair is trading above its 20 Hr moving average and is showing convergence with its 50 Hr moving average.