For the 24 hours to 23:00 GMT, the EUR traded a tad higher against the USD and closed at 1.1339, following upbeat GDP data in Germany.

Data indicated that Germany’s GDP expanded 0.7% on a quarterly basis in 4Q 2014, in line with market expectations and following a 0.1% growth registered in the prior quarter, thus highlighting that the nation still remained as the main growth engine behind Europe’s economic recovery.

However, gains in the Euro were kept in check, after consumer prices in the Euro-zone slid 1.6% MoM in January, worse than a 0.1% fall registered in February, renewing fears of deflation in the common-currency bloc.

Meanwhile, Greece managed to clinch a much needed four-month loan extension, thanks to the country’s Euro-zone creditors who approved a reform plan, after the nation pledged to give away few proposed measures and ensured that the government spending plan would not mess with its budget.

The greenback traded on a weaker footing, after the US Fed Chairwoman, Janet Yellen, indicated that the central bank was anticipated to remain “patient” in deciding over the timing of an interest rate rise in the nation, although adding that a change in the central bank’s policy stance was likely “on a meeting-by-meeting basis”.

The greenback was further weighed down, after the US consumer confidence index fell more than expected to a level of 96.4 in February, compared to prior month’s revised reading of 103.8. Markets were expecting the index to ease to 99.5. Meanwhile, the nation’s Markit services preliminary PMI edged up to a reading of 57.0 in February, beating market forecasts for an advance to a level of 54.5 and compared to a reading of 54.2 recorded in January.

In other economic news, the seasonally adjusted S&P/Case-Shiller composite index of 20 metropolitan areas in the US climbed 0.87% on a monthly basis in December, higher than market expectations for a rise of 0.60%.

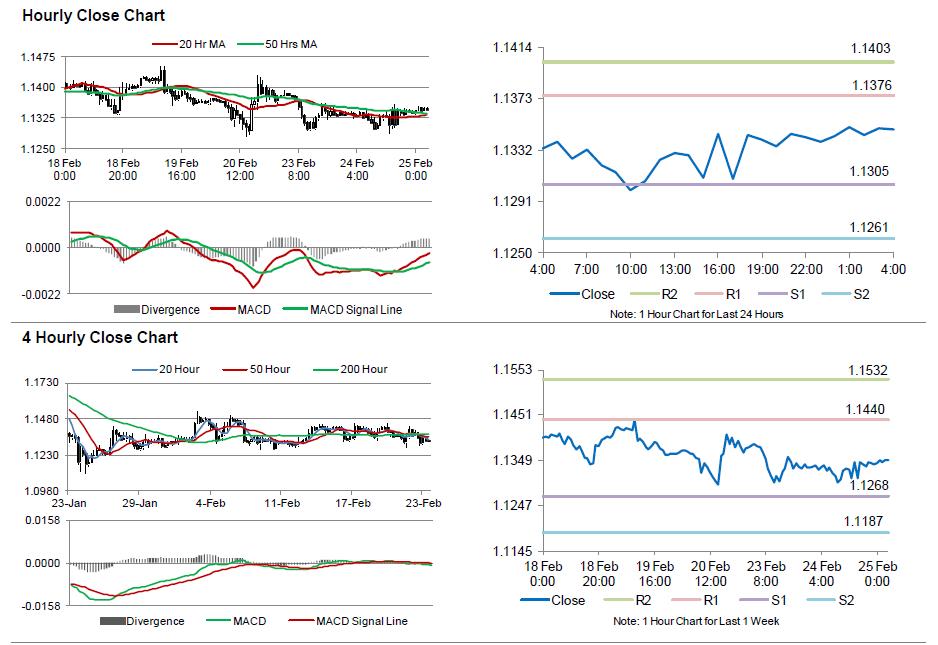

In the Asian session, at GMT0400, the pair is trading at 1.1348, with the EUR trading 0.08% higher from yesterday’s close.

The pair is expected to find support at 1.1305, and a fall through could take it to the next support level of 1.1261. The pair is expected to find its first resistance at 1.1376, and a rise through could take it to the next resistance level of 1.1403.

Trading trends in the Euro today are expected to be determined by the ECB President, Mario Draghi’s speech, scheduled later today. Additionally, the Fed Chairperson, Janet Yellen’s speech would also grab a lot of market attention, scheduled later today.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.