For the 24 hours to 23:00 GMT, the EUR declined 0.27% against the USD and closed at 1.1230, as the Euro region remained in deflationary territory for the fourth consecutive month in May, as consumer prices fell 0.1% YoY.

However, on a monthly basis, the Euro-zone’s consumer price index (CPI) rose above expectations by 0.4% MoM in May, following a flat reading in the previous month.

In the US, CPI rose less-than-expected by 0.2% MoM in May, compared to an advance of 0.4% in the previous month. Markets were anticipating the consumer price index to climb 0.3%. Additionally, the nation’s seasonally adjusted initial jobless claims rose to a level of 277.0K in the week ended 11 June 2016, compared to a level of 264.0K in the previous week. On the other hand, the US NAHB housing market index rose to a level of 60.0 in June, higher than market expectations of a rise to 59.0. The housing market index had recorded a level of 58.0 in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.1263, with the EUR trading 0.29% higher against the USD from yesterday’s close.

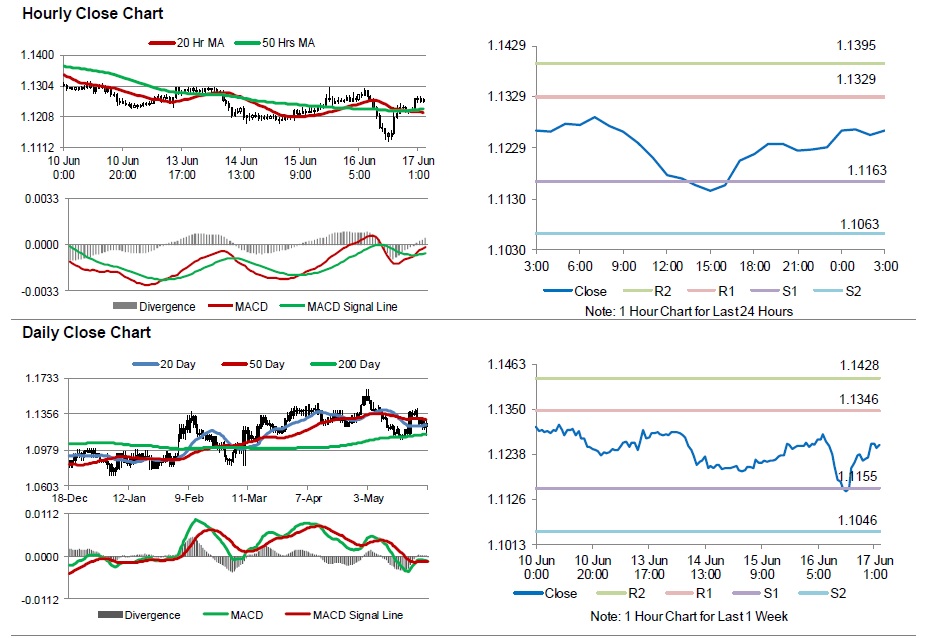

The pair is expected to find support at 1.1163, and a fall through could take it to the next support level of 1.1063. The pair is expected to find its first resistance at 1.1329, and a rise through could take it to the next resistance level of 1.1395.

Going ahead, investors look forward to the ECB President, Mario Draghi’s speech, scheduled later in the day. Moreover, the US housing starts and the Reuters/Michigan consumer sentiment index data, due later today, will also attract market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.