For the 24 hours to 23:00 GMT, the EUR declined 0.08% against the USD and closed at 1.1312, after the Euro-zone’s seasonally adjusted construction output declined 0.2% MoM in April, falling for the third consecutive month, after recording a 1.0% drop in the previous month.

Meanwhile in Germany, producer price index rose 0.4% MoM in May, compared to market expectations for a 0.3% rise and following a 0.1% gain in the previous month.

Separately, the German Bundesbank indicated that the nation’s economy was likely to slow down sharply in the second quarter, largely owing to lower industrial export orders amid fluctuations in the construction sector. However, the central bank assured that growth will rebound later in the year to attain an annual growth rate of 1.7%.

In the Asian session, at GMT0300, the pair is trading at 1.1332, with the EUR trading 0.18% higher against the USD from yesterday’s close.

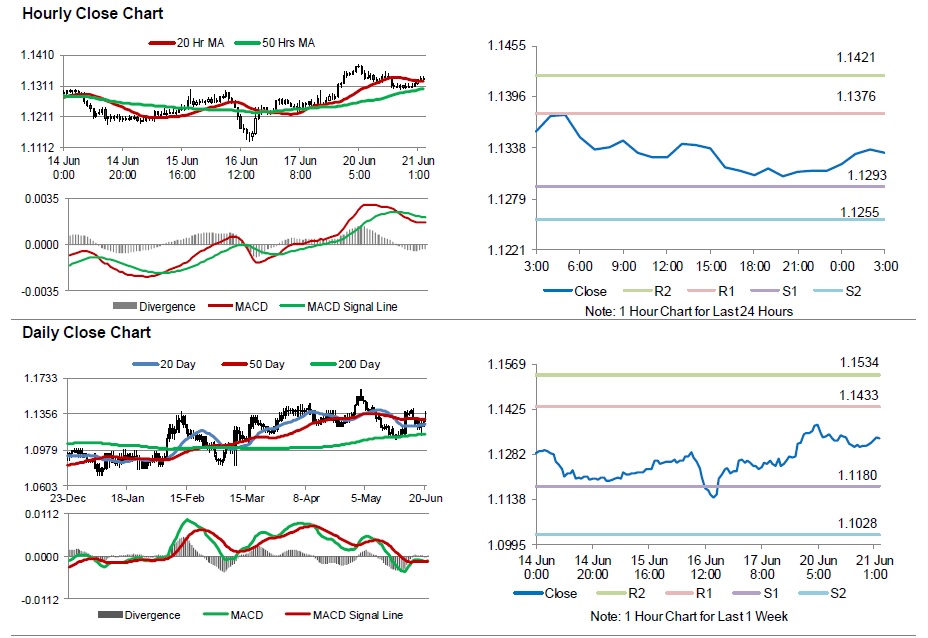

The pair is expected to find support at 1.1293, and a fall through could take it to the next support level of 1.1255. The pair is expected to find its first resistance at 1.1376, and a rise through could take it to the next resistance level of 1.1421.

Going ahead, investors will look forward to the European Central Bank (ECB) President Draghi’s speech as well as Germany’s ZEW survey data, due later in the day. The ECB President pleaded for European unity on 17 June, at his speech in Munich. Additionally, the US Fed Chairwoman, Janet Yellen’s congressional testimony, starting later today, will also attract market attention.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.