For the 24 hours to 23:00 GMT, the EUR declined 0.62% against the USD and closed at 1.2475, as the Euro-zone as well Germany, its biggest economy registered disappointing services PMI figures in October.

Germany’s services PMI expanded less than expected to 54.4 in October, against market expectations for a level of 54.8 and following a similar reading registered in the previous month, indicating a worsening situation in the nation’s economy. Additionally, services activity in the Euro-zone unexpectedly slowed down to 52.3 in October, down from preceding month’s level of 52.4. Meanwhile, the region’s monthly retail sales retreated 1.3% in September, dropping to its lowest level since April 2012, more than market expected drop of 0.8% and compared to a gain of 0.9% recorded in August, thus stoking fears that the region could fall into another recession.

Elsewhere, in France services PMI remained in the contraction territory in October, while Italian services PMI entered the expansion territory in the same month.

In the US, in a noteworthy development, the Republicans gained control of the US senate for the first time since 2006 in the nation’s midterm 2014 elections.

In economic news, the US ISM non-manufacturing PMI dropped to a 4-month low of 57.1 in October, compared to a reading of 58.6 in the previous month. Market expectations were for the index to ease to a level of 58.0. On the other hand, the nation’s ADP private sector employment climbed by 230.0 K in October, more than market anticipations of an advance of 220.0 K jobs.

Yesterday, the Fed Minneapolis President, Narayana Kocherlakota, reiterated his earlier stance and stated that any move by the US Fed to hike interest rate in 2015 would be “inappropriate”, arguing that the Fed’s measure of inflation is unlikely to reach 2% until 2018.

Separately, the Boston Fed President, Eric Rosengren, stated that more disclosure was needed in broker dealer activities in the overnight repo markets.

In the Asian session, at GMT0400, the pair is trading at 1.2488, with the EUR trading 0.1% higher from yesterday’s close.

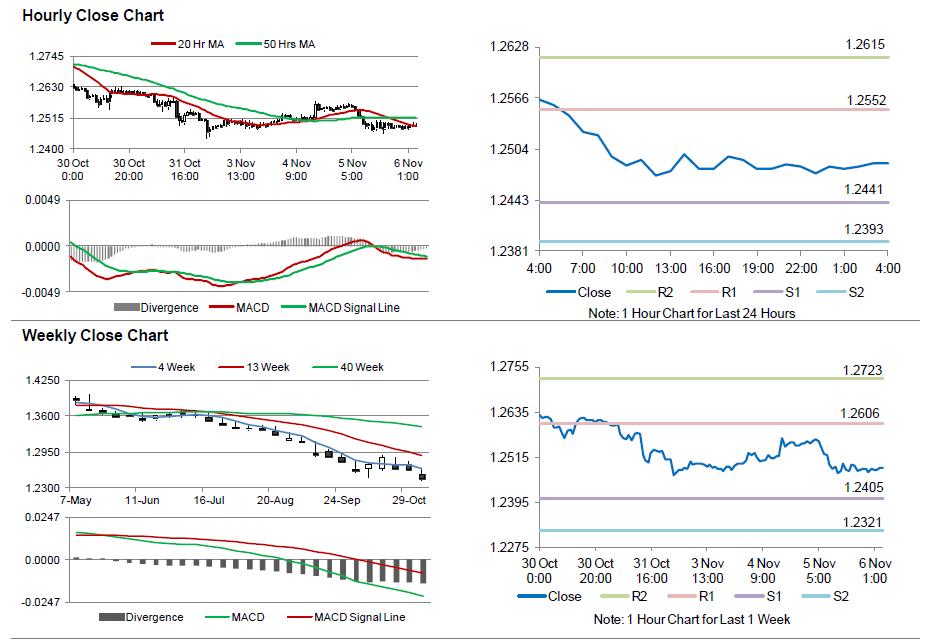

The pair is expected to find support at 1.2441, and a fall through could take it to the next support level of 1.2393. The pair is expected to find its first resistance at 1.2552, and a rise through could take it to the next resistance level of 1.2615.

Trading trends in the Euro today would be governed by the ECB’s interest rate decision, scheduled later today. Meanwhile, investors would closely watch the US initial jobless claims data for further cues

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.